As we turn the page on 2025, it has been pleasing to see many themes for which we were positioned play out during the year. No less encouraging is the fact that the rationale for several of these remains intact.

Take our exposure to commodities, where we see certain critical resources suffering from years of under-investment. This will take time and more than one year of higher prices to correct. Elsewhere, we note parts of the equity market are significantly under-owned by the investment community. Capital flows tend to move in multi-year cycles and we believe the tide may be starting to turn. As we will go on to discuss, this leaves us optimistic about the outlook from here.

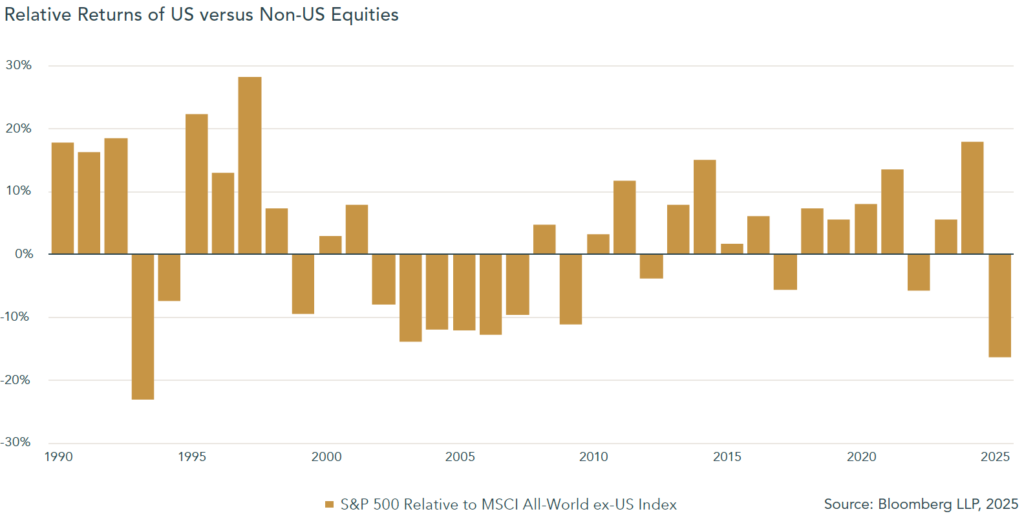

At the start of the year, there was a sense in equity markets that 2025 would be America’s year (again). With the return of President Trump, the US economy was expected to continue outpacing its developed market peers, supported by loose fiscal policy and corporate deregulation. Indeed, the US economy looks set to have grown faster than economists predicted at the start of the year. This is particularly impressive considering the slew of tariffs announced after Liberation Day in April, which were expected to derail growth at the time. The US equity market has also had a good year, with the S&P 500 Index returning an above average 18%, although it lagged the rest of the world which returned 33%. As shown below, it has been over a decade since we last saw such a strong relative year for equities outside the US.

We wrote earlier in the year about the US dollar’s significant depreciation after Liberation Day and the link this has historically had with the relative underperformance of US equities. Both trends tend to persist for a few years when the cycle turns.

Both the US economy and its stock market have recently been supported by the boom in Artificial Intelligence (AI). Capital expenditure connected to the industry has compensated for softening investment in other areas. The large tech companies spearheading AI innovation have also dominated earnings growth recently, helping them outperform the broader US equity market. For now, the market is taking in its stride the heavy investment from these firms in a technology with the potential to enhance all sectors of the economy. Excitement about AI has lifted many large US tech companies to demanding valuations, whilst their performance has created extreme concentration in the S&P 500 index, with the top 10 companies (mostly tech names) accounting for c.40% of its value. Whilst we have some exposure to this ecosystem, we are cognisant that the trade-off between risk and reward looks better elsewhere.

Emerging markets are worth highlighting in this regard, given the pivotal role some constituent companies play in the AI supply chain. Perhaps the best known is Taiwan Semiconductor Manufacturing Company (TSMC), which holds a near-monopoly on the contract manufacturing of the advanced semiconductors that power leading AI models. TSMC is also the largest company in the MSCI Emerging Markets Index. The company’s shares gained 47% in 2025, whilst other AI players such as Samsung Electronics and SK Hynix have delivered 130% and 284% returns respectively. Our portfolios have benefitted from these returns which have come, we believe, from a lower-risk starting point. This is not just a case of valuation, which is indeed more attractive in some of these companies, but by focusing on the ‘picks and shovels’ that will drive the AI revolution, we limit our exposure to the fierce and complex competition for traffic and users further along the supply chain.

Emerging markets more broadly look to be at an interesting juncture. As US interest rates trend lower and the US dollar weakens, central banks in these regions can adopt more accommodative monetary policy without jeopardising their currencies, particularly in countries where inflation is under control. Furthermore, many emerging market countries are significant net importers of oil. While the oil price remains subdued (which we will come on to), consumers and companies across emerging markets will see budgetary pressures ease somewhat. Adding in the naturally higher growth rates in many of these countries, particularly those with young, skilled workforces and centres of world leading innovation, the case for investing in emerging markets continues to look compelling.

Turning back to developed market equities, a major theme this year has been Europe’s response to increasing isolationism from Washington in both trade and foreign policy. Many European countries, most notably Germany, have moved decisively to increase military spending, as well as investing heavily in infrastructure. This change in mindset has been rewarded by investors, with the benchmark MSCI Europe Index closing the year 20% higher. As higher government spending starts to show up in company earnings over the coming years, European equities should be well supported. Furthermore, if the Trump administration continues to seek a weaker dollar to improve the competitiveness of American manufacturing, the Euro is a natural port of call for investors seeking to diversify their currency exposure, which should attract further capital flows into European assets.

This capital flight from the US dollar explains in part the exceptional recent gains in gold and silver which led the charge in a generally strong year for commodities, gaining 65% and 147% respectively. We have exposure to both assets in our portfolios, with gold a longstanding position. Aside from its portfolio construction benefits as a safe haven asset, we believe gold is a useful hedge against inflation in the long run and allows our portfolios to benefit from the structural devaluation of traditional currencies by central banks, including the US dollar. It has proven itself over the long run, returning 1446% since the year 2000. We continue to hold the position with the view that these supportive influences are unlikely to abate in the near term.

Notably absent from the commodity bonanza was the world’s largest resource market: oil. All the more surprising given the increasingly central role that energy is playing in government and corporate policy. The AI industry is already draining considerable energy resources and it is forecast to become significantly more power hungry as it matures. Helped by allies in the Middle East, the Trump administration has been able to keep oil prices depressed through plentiful supply. With inflation still a key concern for US voters, the President will likely continue to seek deals which keep petrol prices down. Trump has also doubled down on efforts to tap into the potential of nuclear energy, benefitting the uranium miners to which we have some exposure.

The last twelve months have seen numerous drivers of performance across global markets, with opportunities to invest profitably in various regions and asset classes. We expect this breadth of opportunity to continue into the foreseeable future and believe our genuinely global, benchmark agnostic investment strategy stands us in good stead for such an environment, as proved to be the case in 2025.

Fred Hervey

Chief Investment Officer