It has been a testing time for investors in China, which has experienced a series of shocks to the investment backdrop that have spilled over into all sectors of the equity market, both in Shanghai and in Hong Kong. In what follows, we will explain why, in the face of considerable bad publicity, we retain exposure to Chinese equities and have strong conviction in their prospective returns for the patient investor.

Chinese markets have experienced more than a year of sustained selling pressure by developed market institutions. Last year, regulatory interventions from Beijing reached a crescendo over the summer, with a string of announcements from the government which were perceived by the market as anti-business. With sentiment around Chinese equities fraying, the news that the country’s largest property developers were going to default on debt obligations created an outright bear market for Chinese equities, as investors worried about the impact of the sector on the wider economy, as well as disclosure and management quality among local companies. The underlying operational performance of Chinese companies has, in fact, continued to be positive in many cases. However, speculation increased regarding the ability of these companies to sustain the exceptional performance they have delivered in recent years.

As we moved into 2022, in a difficult period for equities in general, the ramifications of China’s strict zero-covid policy started to emerge. With the government having enforced strict restrictions to contain localised outbreaks of the virus, large cities were forced into lockdown yet again. Shanghai, for example, which contributes over 3% of the country’s GDP and over 10% of its trade, was shuttered for two months, dragging Chinese equities lower, particularly consumer-focused names. With vaccination rates behind many developed economies and a healthcare system not equipped to cope with a pandemic, President Xi Jinping has been backed into a corner. If he relaxes the zero-covid policy, he risks placing the healthcare system under duress in an election year, as well as attracting scrutiny of the government’s pandemic strategy to date. Consequently, lockdowns are likely to continue, perhaps until the World Health Organisation re-classifies the Covid-19 pandemic as endemic, which may allow Xi to change tack. Given what has happened over the last 18 months, it is no surprise that a leading investment bank concluded earlier this year that China is not an investable market. Ironically, the Wall Street strategist to make this claim has recently upgraded his forecast for several Chinese equities.

The recent regulatory crackdown must be viewed through the lens of Beijing’s social agenda. This agenda is nuanced, but well understood by those living and working in China. In August 2021, Xi Jinping introduced the concept of common prosperity, aiming to balance growth and social order. The social interventions announced last summer included a crackdown on excessive gaming among youths. This is one of many measures designed to protect consumers, with addictive products and services such as tobacco, gambling and unhealthy gaming having been subject to regulation for some time. In the corporate sphere, lawmakers are focused on tackling the cost of doing business for small companies, showing hostility towards monopolies in certain sectors. It is hoped that by encouraging fair competition and promoting innovation, economic growth will be stronger and distributed more fairly. China has also publicly committed to reducing its carbon footprint, with the President having pledged to make the country carbon neutral by 2060. We believe that officials have made it clear that they want a certain type of economic growth, and investors that position tactically to benefit from China’s next economic and social phase should be well rewarded in the long run.

The raft of regulatory measures announced by the Chinese Communist Party must also be viewed in the context of China’s maturing economy. State officials have been forthright about their objective of population growth for some time, with the legacy of the so-called ‘one-child policy’ of the late 20th century leaving them with the problem of an ageing population. Young people are the driving force behind economic growth, whilst ageing populations are expensive to look after, so the government is taking steps to try and address its demographic imbalance. For example, it has targeted high property prices and high tuition costs which are seen as barriers to having more children. Consequently, it has been better to avoid equity market sectors that are exposed to these dynamics.

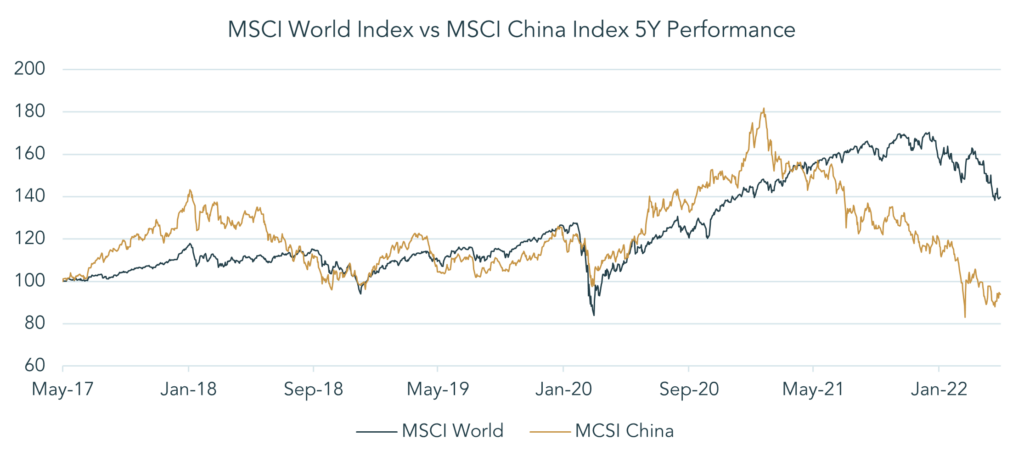

Away from regulation, The Evergrande Group, China’s second largest property developer, has single-handedly dealt a huge blow to investor sentiment, as it announced that it would default on its mountainous debt pile. Other Chinese property developers have subsequently made similar disclosures. For many local managers, Evergrande has been a ticking time bomb best avoided. However, as a substantial company, it accounted for a meaningful proportion of the equity indices tracked by passive investment vehicles, such as the MSCI China Index shown below. A slide in Chinese property shares has certainly contributed to the sustained period of underperformance of MSCI China compared with MSCI World since early last year. However, we note that there has historically been a negative correlation between

Chinese property prices and equity market movements. Indeed, when new home prices fell in 2014, the Chinese stock market went on the strongest rally of this decade. Weakness in the Chinese property market should not, therefore, be analysed in quite the same way as one might evaluate weakness in the UK property market, for example.

Source: Bloomberg LLP, 2022

ITurning to geopolitics, a key risk in the region remains China’s relationship with Taiwan, a disputed territory over which China claims sovereignty. The island has been brought into sharper focus by the war in Ukraine, and the West’s response to Russia’s aggression in comparison to China’s stance which has been ambiguous at best. On a visit to Japan, President Biden recently indicated his commitment to military support for Taiwan in the event of a Chinese invasion, somewhat rashly perhaps removing any ambiguity that may have been present in US foreign policy to date. While this could be perceived as an escalation, we feel that on balance this posturing from the US should reduce the probability of military action on the island. The caveat here would be an unexpected declaration of independence by Taiwan itself, something that would be inflammatory, but an action to which we ascribe low probability given its limited benefit for any party.

The situation in Taiwan is indicative of a broader shift in international relations. It is clear that the political paths of the world’s two great economic powers, the US and China, will continue to diverge as they seek to reduce financial and supply chain integration and re-enforce their respective political alliances. A reduced interdependence between the two countries may spell the end of globalisation as we know it. Instead, we expect the emergence of an economic and political duality, with distinct Chinese and US spheres of influence, each respectively self-sufficient. The question then becomes whether investing across these battle lines turns out to be an arbitrage opportunity, or a capital allocation mistake. We believe it is the former.

At a portfolio level, the addition of Chinese equities enhances diversification which carries a benefit for aggregate portfolio risk. Over the last 3 years the weekly correlation of the MSCI China Index to the global equity market has been approximately half that of developed market indices such as the S&P 500 and the MSCI Europe ex UK Index. Chinese equities also offer a potential source of significant excess returns given the historically low valuations on which the market currently trades. As at the end of March 2022, the global equity market was priced at 18 times its forecast earnings for the year ahead, whereas the equivalent measure for the MSCI China Index was 11 times.

When considering what might be the catalyst to close this valuation gap, the contrasting position of China’s central bank compared with the Federal Reserve and other developed market banks is certainly worth noting. The People’s Bank of China (PBOC) continues to loosen monetary policy whilst the rest of the world is forced into tightening by elevated inflation levels. By cutting the reserve requirement ratio (RRR), the PBOC hopes to boost lending and improve liquidity in the economy. The PBOC has further monetary ammunition to stimulate its economy if required, a luxury not enjoyed by

many other large central banks. These supportive monetary conditions, historically a precursor to equity market rallies, make for an attractive backdrop to the China equity story.

Over the last 18 months, the Chinese market has had to digest a zero-covid policy, regulatory change, a property slowdown and geopolitical risk. The nature of these events, sector-specific in many cases, highlights the need for active fund management in the region. Today, Chinese equities are left trading at valuations which we believe largely reflects the recent bad news. Looking forward, with its genuine diversification benefits, supportive monetary policy and attractive current valuations, we have high conviction in the opportunity that China offers to our managers in the region.

Lincoln Private Investment Office