Commodity companies have suffered years of underinvestment which has created an ever-widening gap between future demand and future supply. As the world transitions to a more sustainable future, we believe commodity equities currently offer investors an attractive entry point to a lasting secular theme. Financial markets have been happy to spurn the natural resources sector without consideration for how the world of the future will be powered, or where the requisite inputs will come from to enable the decarbonisation of the global economy. As a result of the structural shortages in these crucial resources, we believe the sector will prove a rich hunting ground for investors in the coming years.

Copper is one such resource in short supply. Regardless of which technology wins in the race to electrify the world’s fleet of vehicles, copper is a key component of all the leading battery technologies. Demand is forecast to grow substantially, bolstered by the thematic tailwind of electrification, which has been embraced by developed and developing economies alike. Commodity investors such as Tribeca Investment Partners forecast that the copper industry alone will require at least $100bn of investment to meet the world’s 2050 decarbonisation goals. Whilst metal prices will inevitably be buffeted by recessionary fears, key commodities like copper will enjoy structural demand that is likely to dwarf any temporary softening of demand during a recession. The copper market is already in deficit and inventory levels are tight, with analysts predicting production of just 26 million tonnes in 2030, compared with expected demand of 34 million tonnes.

The solution to this shortfall is a significantly higher copper price to incentivise exploration, but such projects typically take over ten years to reach production. With near-surface deposits of copper becoming increasingly rare, the lead times on new supply are only getting longer as miners are forced to dig deeper or employ new techniques to access underground reserves. As well as being time consuming, significant deposits require capital expenditure running into the billions to bring into production. Only the largest miners in the world have the requisite expertise and funding to see projects of such scale and complexity through to completion.

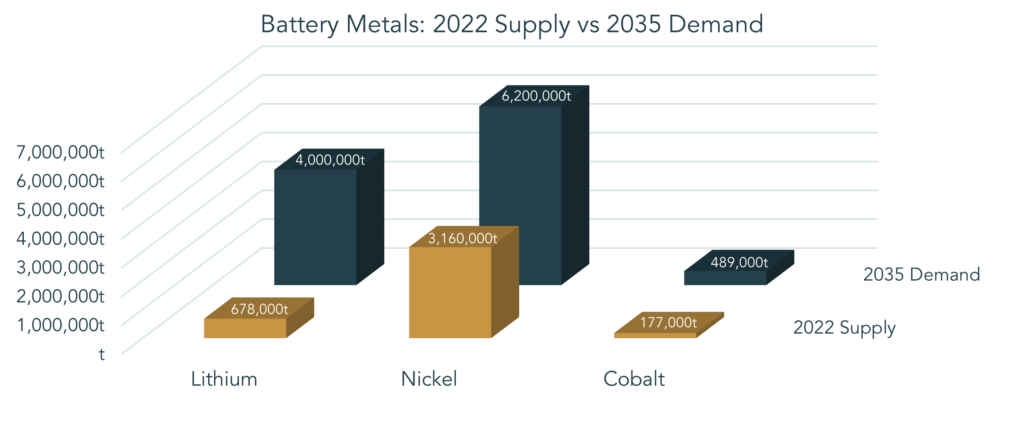

It is not just copper that is required for electrification. Other metals necessary for the production of batteries, such as lithium, nickel and cobalt also face large supply shortfalls in the future. The chart below illustrates 2022 production levels (gold columns) and those required by 2035 (blue columns). The difference between the two indicates just how much supply must come on-line over the next decade. In fact, by 2035, it is projected that the world will need over 80 new lithium mines, 80 new nickel mines and almost 70 new cobalt mines. Batteries utilising these metals are essential for the greenification of the world, yet most companies are currently not incentivised to make capital commitments towards mining them. Higher commodity prices are needed to make new projects more viable, whilst a rally in mining equities will give these companies access to cheaper financing to support such projects.

Source: Benchmark Mineral Intelligence, United States Geological Survey, via Tribeca Investment Partners

Some forward-thinking mining companies are ramping up corporate activity in an attempt to capitalise on cheap valuations in the sector. For example, mining conglomerate BHP recently completed the takeover of OZ Minerals, a copper miner based in Australia. Furthermore, a mammoth takeover bid for Teck Resources by diversified miner Glencore and the purchase of Newcrest by number one gold miner Newmont for nearly $20bn indicate that companies of all sizes are targets for conglomerates looking to bolster their assets. In total, the value of corporate mergers and acquisitions completed in Q1 2023 rose 20% quarter-on-quarter and 30% year-on-year to over $33bn. With natural resources currently undervalued by the market, we expect corporate activity to continue across all levels of market capitalisation.

In the meantime, it is hard to deny that fossil fuels will power the planet in the interim, with oil likely to remain the principal energy source for some time yet. Recent developments in the market, including OPEC’s surprise decision to cut over a million barrels per day of production, have done little to stem market losses over the year-to-date. Recessionary fears have left futures contracts indicating that market participants expect oil prices to fall further from here. However, the extreme lack of investment in asset exploration and development has left the supply in the market out of kilter with expected demand. Additionally, the US Strategic Petroleum Reserve is now half empty and requires around 350 million barrels of oil to be refilled, which is likely to place a floor under prices for some time. We would expect a higher market price over the medium term as renewables remain unable to fulfil total demand, especially that of a 24-hour world where constant power is required, which neither solar nor wind power can deliver.

This requirement for baseload energy brought another energy source back into the collective conscience as a viable alternative. Nuclear is the only large-scale, carbon-neutral source of 24-hour power currently available. Despite previous negative sentiment, governments have begun to re-engage with uranium as a tool to meet climate goals and retain energy security. The US recently moved to form a ‘Strategic Uranium Reserve’, whilst Japan is restarting all of its dormant nuclear reactors. Thanks to this, and other developments such as the build-out of nuclear capacity in China and India, we are optimistic about the prospects for uranium miners, with the metal likely to form a crucial part of a sustainable global energy mix going forward. With utilities sitting on dwindling stockpiles of inventory and the uranium spot price trading 30% below the equilibrium price for the industry, we believe significant price appreciation is probable. Momentum in uranium should lead to an even greater re-pricing of related equities, which currently have minimal institutional sponsorship and a combined market capitalisation far below what would be expected of a globally critical resource sector.

There are many opportunities to take advantage of the seismic shift in the world’s energy complex. With numerous commodity markets operating out of equilibrium, we believe rising commodity prices will provide a tailwind for many equities in the sector. From today’s low valuations, we feel the range of outcomes is asymmetrically skewed to the upside.

Lincoln Private Investment Office