The past three months have felt like a crescendo of political noise. The diplomatic style of the current US administration is forcing a reaction from their counterparts across the world; very much Trump’s intention in some cases. For investors, politics has always presented the challenge of distinguishing between noise and structural change.

Historically, political events have largely fallen into the former camp as far as investment outcomes are concerned, with a few notable exceptions. It feels as though we are currently living through a period which could throw up more notable exceptions than usual. As government policy levers converge to address existential issues, it is becoming ever more important to consider the investment sphere in the context of the political. We take this opportunity to highlight some key recent developments in this regard.

Perhaps the best example of politicians exerting influence in new ways is the pressure the Trump administration has been putting on the Federal Reserve, a constitutionally independent entity. The US central bank’s independence has certainly been called into question in the past and indeed the perceived leftist bias of the incumbent policymakers is likely motivating Trump’s interventions. However, the President has gone beyond calls for lower interest rates which have been a feature of political rhetoric on both the left and right. Alongside berating what he sees as overly hawkish policy, he threatened to fire Fed Chair Jerome Powell before backtracking. He has not, however, backed down on attempts to oust policymaker Lisa Cook for alleged impropriety. Having appointed ally Stephen Miran to the Fed’s Board of Governors after one of its members resigned in August, the Supreme Court is now in the process of deciding if the President will get the chance to replace Cook with another candidate who is sympathetic to his preference for lower interest rates. Success for Trump on this case would leave four of the seven on the Board of Governors inclined in this way.

The quarter ended with the Fed reducing rates by 0.25% for the first time this year in response to some weakening labour market data. In July, the Bureau of Labour Statistics (BLS) published its monthly jobs data which revealed job growth considerably below economists’ expectations. In addition, the data for May and June were revised downward by a combined 258,000 jobs, representing the largest such two-month revision since 1979 (excluding the pandemic period). In response, President Trump fired the head of the BLS, Erika McEntarfer, an unprecedented move. The accuracy of statistical data is certainly a cause for concern, particularly if it feeds into monetary policy decisions. It remains to be seen whether the appointment of a Trump-friendly candidate improves the quality of the jobs data. In any case, with tougher immigration policy tempering the natural rate of jobs growth in the US (due to lower labour supply), the case for immediate rate cuts

by the Fed looks uncertain. Advocates also point to a lack of inflationary pressure from tariffs to date. With accelerated shipments before the April announcements, the depletion of inventory and some margin compromise from corporates likely distorting the data we have seen to date, we would argue it is too early to draw this conclusion.

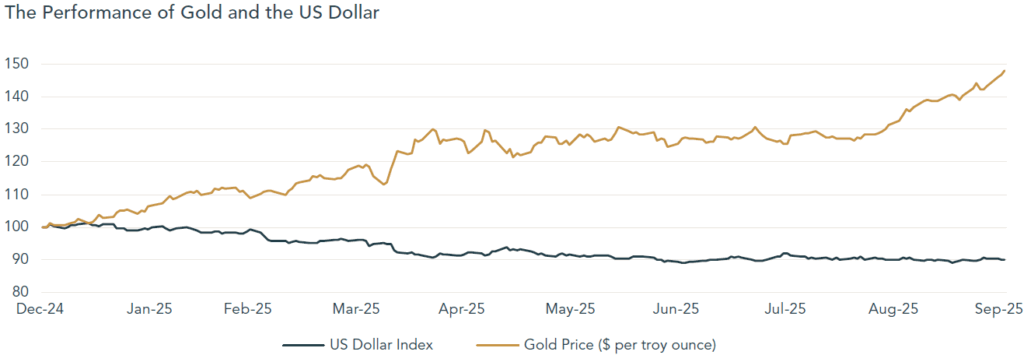

Nonetheless, equities and bonds have broadly taken these events in their stride. Having tumbled when President Trump announced the tariffs in April, US equities have rebounded 34% from their lows. The US bond market was also disconcerted at the time, but volatility in Treasuries has since subsided. The US dollar, meanwhile, is telling a different story. Whether politically motivated or driven by weakening economic data, the expectation of further interest rate cuts in the US has kept downward pressure on the currency. The US Dollar Index, a measure of the dollar’s performance against a basket of major currencies, is down 10% over the year to date. Investors are interpreting this significant drop in different ways, including a fundamental connection with falling interest rates, deteriorating government finances, apprehension regarding the pressure on key economic institutions and some over-due mean reversion after several years of phenomenal dollar strength. We see many of these factors persisting into the medium term and as such expect the US dollar to continue weakening, albeit not in a linear fashion.

We have written on a few occasions this year about the important investment implications of a weakening US dollar. Commodities have historically responded particularly well in times of dollar weakness. Evidence from the year to date would suggest this relationship is very much intact. The standout performer amongst the major commodities has been gold, with an astonishing gain of 47% this year. Like the move in the dollar, it is hard to ascribe this performance to a single factor. Many of the drivers of dollar weakness are bullish factors for gold and form part of the reason that we maintain exposure to it within our client portfolios. In addition, we would highlight gold’s potential to act as an inflation hedge, an attractive quality at a time when interest rates are being cut despite inflation running above the Fed’s target range. Central banks around the world have been stockpiling gold at a furious pace in recent years as an alternative to holding currency reserves. China’s central bank has been particularly active in this regard, as well as the Chinese government mandating insurance companies to hold gold as part of their reserves. With gold comprising just 5% of central bank reserves today compared with 20% in 1980, we see this as a sustainable source of demand for the yellow metal.

Source: Bloomberg LLP, 2025

Outside of the US, politics has been shaping the economic fortunes of Europe’s second and third largest economies too. Prime Minister François Bayrou, appointed after several short-lived predecessors to lead France’s highly fragmented parliament, pushed through a deeply unpopular austerity budget to tackle a surging public deficit, which had far exceeded the EU’s threshold limit of 3% of GDP. This triggered fierce opposition from both left and right, culminating in a crushing defeat for Bayrou in a confidence vote in September, the first time since 1958 a French Prime Minister has lost such a vote. Bayrou resigned and was replaced by Sébastien Lecornu, but deep divisions and uncertainty persist, as do mounting worries over France’s finances. Italy, by contrast, has been restoring confidence in its finances under Prime Minister Giorgia Meloni, with the budget deficit set to fall below 3% of GDP this year, the first time since 2019. Long seen as a weak link in the European economy, Italy’s government bonds have historically always traded at a discount to France’s. This year, this discount vanished and Italian bonds in fact traded at a small premium.

Japan also saw the departure of a Prime Minister, in this case Prime Minister Shigeru Ishiba who has been leading the LDP’s minority government since 2024. Pressure had been building on Ishiba to resign over issues including rising living costs, immigration and a costly trade agreement with the United States that drew significant domestic criticism. With his resignation having been announced in September, the LDP will hold snap leadership elections in October which will determine Japan’s new leader. The muted response of Japanese asset prices to the news suggests the market has confined these events to the ‘noise’ camp of political developments. Our assessment of the candidates likely to replace Ishiba would support this conclusion and we believe the structural factors underpinning our positive view on Japanese equities, namely corporate reform and building economic momentum, will remain in place.

Looking across all this seemingly rapid change, one key instrument in our investment toolkit is our long-term perspective. We look for the exceptions in the noise which leave clues to profound shifts in the investment landscape, such as a structural weakening in the world’s dominant currency (the US dollar). In this specific case, we believe the best course of action is to hold exposure to assets which benefit from a weaker dollar environment, such as emerging markets and commodities, both of which have contributed meaningfully to returns in our client portfolios this year. Given the extreme concentration and euphoria in parts of the equity market today, focusing on these long-term drivers of investment returns should enable us to deliver performance which is both persistent and sustainable. This approach leads us to hold a truly global asset allocation, with meaningful exposure to a diverse range of growth drivers across the world.

Fred Hervey

Chief Investment Officer