The second quarter produced a few events which appear genuinely historic in nature. Whether or not they prove transformational for financial markets will depend on the degree of follow-through from politicians around the world, particularly in relation to trade and defence policy. We take this opportunity to highlight what we believe are some of the most important developments before going on to discuss some nascent trends which have emerged in markets.

April commenced with all eyes on President Trump, with US trade policy quickly becoming the most influential factor driving market moves. On 2nd April, the White House announced a universal tariff of 10% on all US imports, with other levies on specific industries including 50% on steel and aluminium imports, and 25% on automobiles. There were also country-specific measures including a tax on Chinese goods which peaked at an eye-watering 145%, with China reciprocating at 125%. As the world’s largest economy dramatically reversed decades of pro-globalisation trade policy, markets were sent into turmoil. Measures of equity market volatility jumped by levels only ever seen during the outbreak of Covid-19 in 2020, whilst the S&P 500 index of US equities fell by 19% from peak to trough.

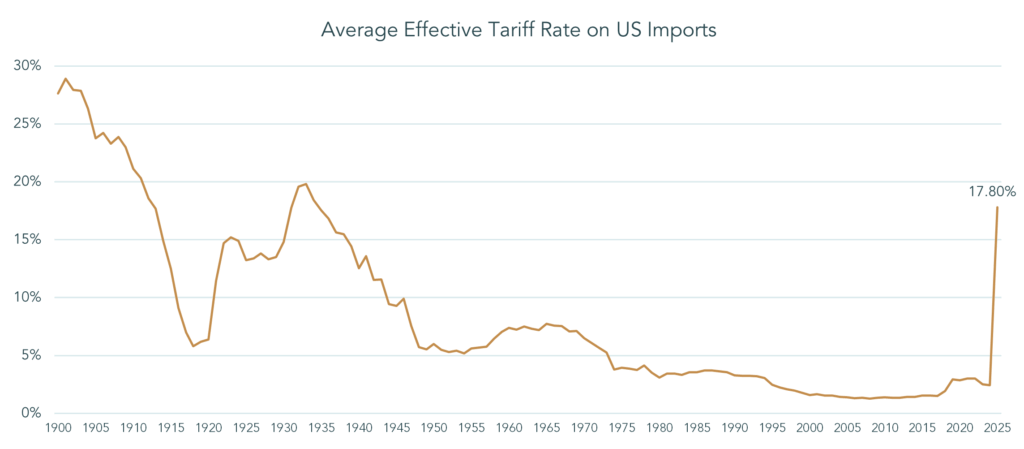

What happened in the weeks that followed was equally dramatic. With equities tumbling and US government borrowing costs climbing rapidly, President Trump announced a 90-day delay on many of the most severe tariffs he had proposed. The markets were reassured by this evidence that the President seems mindful of the financial implications of his policies and took further comfort in his deal-making rhetoric. With the tariff package temporarily reduced to a universal rate of 10% and a handful of industry-specific taxes, the US equity market quickly erased its losses and closed the quarter at all-time highs, shrugging off the risks associated with the delayed tariff deadline on 9th July. The recovery is especially remarkable when one considers that, even with tariffs at their temporarily reduced levels, the cost of trading with the US has still increased to its highest level in nearly a century, as shown in the chart below.

Source: Budget Lab at Yale, U.S. Global Investors, May 2025

Equity markets were buoyant in May and June despite soft data (survey-based statistics) flashing red in March and April and many prominent economists forecasting a tariff-induced recession. Nonetheless, the US economy as measured by hard data – official data releases from government agencies reflecting real economic activity – has held up so far. This divergence between hard and soft data has gained increasing attention recently, with the economy looking quite resilient in the first two months that this fresh bout of tariffs has been in force. Historically these two types of data have converged quite quickly and indeed some of the soft data is showing signs of recovery.

The market was similarly willing to take the troubling conflict between Israel and Iran in its stride, including the unexpected bombing of Iranian nuclear infrastructure by the US military. This decisive, high-stakes intervention by the US led to a ceasefire which remains in place at the time of writing, with the economic impact of the conflict also seemingly contained for the time being, reflected by Brent crude oil’s retreat from over $80 per barrel to $67 at the end of June. From the market’s perspective, one major known economic risk relating to the conflict is the potential closure of the Strait of Hormuz, a crucial shipping channel through which c.20% of the world’s oil and gas passes. This option is openly being considered by Iranian lawmakers but is ascribed a low probability given the devastating impact it would have on Iran’s economy and the inconvenience it would cause to China, which buys most of Iran’s oil.

Whilst US equities and bonds ended the quarter in positive territory, a clue that the market has not forgotten the events of this quarter can be found in the path of the US dollar which finished the quarter 9.2% lower as measured by the U.S. Dollar Index. This dollar weakness has come about despite the options market increasingly implying higher US interest rate expectations for the remainder of 2025. All other things being equal, higher interest rates in the US tend to strengthen the dollar as capital is attracted by the higher returns on offer. The breakdown of this relationship is telling. As we wrote about in a recent Market View piece, the Trump administration’s pursuit of expansionary fiscal policy via tax cuts has combined with volatile trade policy to raise some questions about the dominant role that the US dollar plays in financial markets. With nearly 60% of global foreign exchange reserves held in US dollars, it is certainly conceivable that we could see a continued rebalancing at the dollar’s expense.

In the same piece, we discussed the assets that have traditionally performed well during periods of dollar weakness. Commodities and Emerging Market Equities are often particularly good performers in these times but in general, equity markets outside the US tend to outperform. The dollar downtrend is in its infancy and indeed there are good reasons to think it may reverse at some point, not least given the interest rate relationship mentioned above. However, the first six months of this year have shown that a softening dollar throws up plenty of opportunities for multi-asset investors like us to capitalise on. Gold has been the standout of the mainstream commodities, generating returns of 26.9% in the first half of 2025. Meanwhile in equities, Europe and Emerging Markets have meaningfully outperformed the US with returns of 10.2% and 15.5% respectively over the same period, compared with 6.2% from the S&P 500. Factoring in the dollar’s depreciation, the S&P 500 has produced a negative return for sterling investors.

In the case of Europe, there is more at play than euro strength against the dollar. Trump’s belligerent style of international relations has galvanised politicians in Europe and elsewhere around the goal of self-sufficiency. At the 2025 NATO Summit in The Hague, Allies made a commitment to investing 5% of GDP annually on core defence and related infrastructure by 2035. This follows significant momentum in Europe surrounding defence commitments and associated government spending. Germany has been at the forefront of this under newly-elected Chancellor Merz, committing to increase defence spending from 2.4% of GDP to 3.5% by 2029 and establishing a €500bn infrastructure fund which sits outside of the ‘fiscal brake’ which has historically limited German government spending. We believe the region is well-stocked with listed equities that stand to benefit from a change in mindset amongst European leaders, with many companies still trading at undemanding valuations despite their strong returns over the year to date.

The reason for raising these strong year-to-date performers is to illustrate the broader point that for all the unsettling headlines, there are plenty of things to be positive about from an investment perspective. We are pleased to have a truly global asset allocation within our portfolios, with a good deal of flexibility in terms of implementation. This allows us to act on new information in the best interests of our clients, without arbitrary constraints. Therefore, whilst we feel that parts of the market look expensive against a backdrop of elevated uncertainty, we finish the quarter with our portfolios almost fully invested and positioned constructively in numerous themes outside these areas of the market. As the world evolves, we are excited about the inherent advantages of our investment approach.

Fred Hervey

Chief Investment Officer