In an eventful quarter, markets have begun to question US exceptionalism, a concept which buoyed many US

assets when President Trump secured an election victory in November.

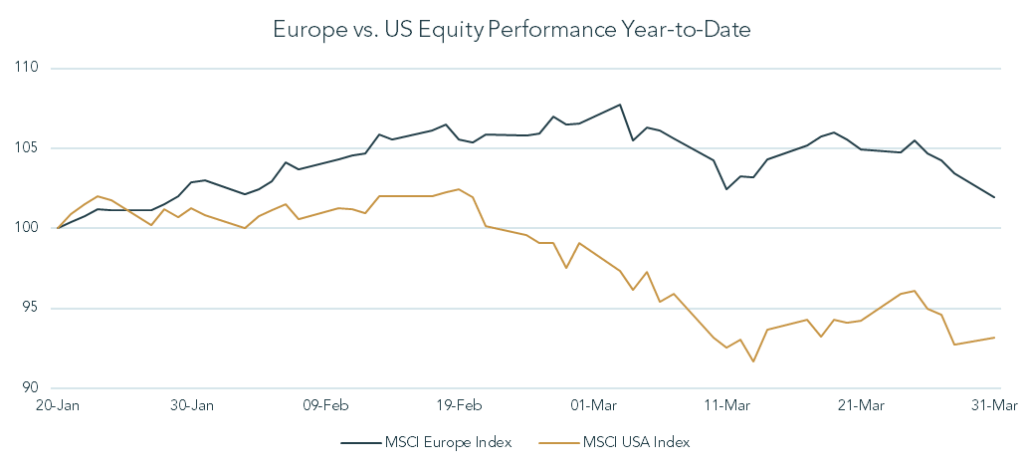

However, as the euphoria of Trump’s win has faded, the market has begun to re-evaluate what Trump’s arrival in the White House really means for the world’s financial assets. Interestingly, US equities have been exceptional in their weakness this quarter, posting their biggest quarterly underperformance versus the rest of the world since 2002. By contrast, the equities of two key foreign adversaries. President Trump identified on the campaign trail, China and Europe, have been the strongest performers. We take this opportunity to discuss what lies behind this divergence, highlighting some fundamental drivers we believe stand a good chance of persisting into the future.

President Trump’s ambition to Make America Great Again (MAGA) looks to have kickstarted an initiative that has come to be known colloquially as MEGA: Make Europe Great Again. At the time of writing, the US had announced 25% tariffs on steel and aluminium exports from the EU, as well as a 25% levy on automobiles and auto parts, a major European industry. Trump had also hinted at the idea of broader tariffs that could impact Europe, including medical supplies, semiconductors and various natural resources. For all the outrage this commercial hostility has caused in Europe, it has also prompted European politicians to sharpen their pencils on economic policy. Perhaps most notably, incoming German Chancellor Friedrich Merz used the momentum from his election victory in March to loosen Germany’s relatively conversative fiscal rules. Key policies include the exemption of defence spending over 1% of GDP from constitutional fiscal limits, as well as the establishment of a €500 billion infrastructure fund outside these limits.

The UK and France, among others, have also committed to increasing spending on defence from 2.3% and 2.1% of GDP currently to 3.0% and 3.5% respectively. This has come in response to President Trump’s attempts to broker a peace deal between Russia and Ukraine. The probability of such an outcome has risen, but it remains low. However, in the negotiation process, the US has pared back its previously unconditional support for Ukraine and appears open to softening its relations with Russia, subject to certain as yet unmet conditions. The rhetoric from the new US administration towards Europe has not been subtle: America’s allies must pull their weight on defence and cannot rely on unconditional US military support.

As we wrote in our previous letter, European equities entered 2025 with some key ingredients for a period of outperformance: cheap valuations and economic activity surprising to the upside. The marginally improved prospects of peace in Ukraine, coupled with an improving Chinese economy (which we will go on to discuss), has led to a strong quarter of performance for the European market. The charge was led by defence companies which stand to benefit from a structural reallocation of resources by European governments in their favour. The relative performance of broad European and US equity indices is show on the graph below. We see these capital flows into Europe as sustainable and are positioned in assets that should continue to benefit.

Source: Bloomberg LLP, 2025

As with Europe, the US equity market’s recent performance is not completely detached from the economy. Some data has indeed been indicating that softer growth and higher inflation may lie ahead (a combination known as stagflation). Two key areas appear to be worrying investors. Firstly, the aggressive cost-cutting measures being undertaken by the Department of Government Efficiency (DOGE), including mass redundancies in federal departments, are likely to lead to higher unemployment at least in the near term. Secondly, the fact that President Trump has chosen to prioritise belligerent trade policy during his first few weeks in office.

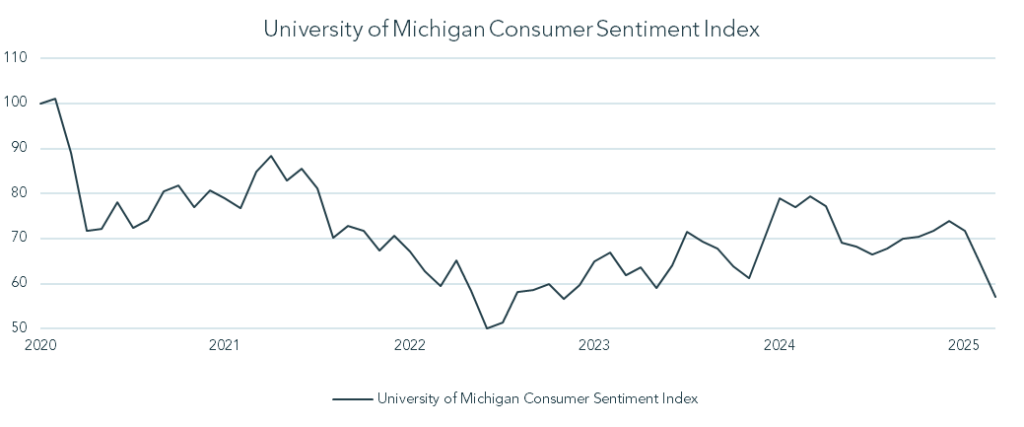

In isolation, tariffs have the effect of raising prices for consumers and reducing consumption as prices rise. To compound this headwind, the Trump administration has been varying the size, timing and targets of these import levies on what feels like a daily basis, causing heightened uncertainty across the economy. The arresting impact of this policy-induced uncertainty can be seen in monthly surveys of housebuilders, small businesses and consumers, to name a few, with spending and investment falling and participants expressing increased apprehension about the future. The recent weakness in the widely followed University of Michigan Consumer Sentiment Index is shown on the next page.

Source: University of Michigan, 2025

For now, most economic data continues to reflect a relatively robust US economy. Moreover, the picture painted by survey data is not clear-cut. For example, the readings from the survey above vary considerably by political bias, with respondents that voted Democrat much more likely to express pessimism regarding the outlook. Indeed, other alternative data sources, such as credit card delinquencies, have been trending positively in recent weeks. This is especially true of data relating to high-income consumers, a cohort with a disproportionate impact on US GDP growth. Overall, the picture remains quite finely balanced. We would note that our positioning in US equities is skewed towards companies that should benefit from Trump’s agenda of deregulation and tax cuts, pledges to which he remains committed that have been somewhat lost in the noise surrounding trade policy.

A good degree of the strength in US equities last year came from bullish investor sentiment surrounding the major advancements in artificial intelligence (AI), with significant associated capital expenditures from the largest technology companies to gain and secure an advantage in the industry. The greatest beneficiaries from this capital expenditure were therefore caught off guard in late January, when Chinese technology company DeepSeek announced that it had built a high-quality AI model using much cheaper infrastructure than its US peers, including lower grade semiconductors. Technology shares in the US initially reacted by tumbling lower, before recovering some losses as it became clear that the consequences of this leap forward in Chinese innovation had more nuanced implications than first thought.

Whether or not DeepSeek and others like it pose a fundamental threat to the dominance of the US in AI, Q1 served various reminders of China’s immense appetite and capability for innovation. For example, Chinese automaker BYD unveiled a new charging system that adds 470km in range to its car batteries in just five minutes, putting it firmly at the front of the global race for dominance in electric vehicle batteries. Whilst the market had perhaps never really forgotten China’s capabilities, for much of 2023 and 2024 it penalised Chinese equities for the perceived lack of support from the Chinese Communist Party (CCP) for entrepreneurship and investment. This adverse backdrop has thawed materially in recent months. Markets were relieved when the Chinese government announced significant fiscal support for their slowing economy, including an increase in the fiscal deficit from 3% to 4% of GDP and one-time pay increases to state workers, as well as targeted measures to stimulate an ailing property market and boost consumer spending. These measures are beginning to show up in economic indicators.

On top of these formal steps, Chinese policymakers have also made several significant pro-business gestures. Perhaps the standout was a recent business symposium hosted by President Xi Jinping which included many high-profile technology executives including Alibaba co-founder Jack Ma, whose business was recently subject to some of Beijing’s most anti-capitalist measures. This show of support for private enterprise comes alongside state-sponsored investments in AI, quantum computing, and green technology, supported by a $138bn tech fund, aiming to reducing China’s reliance on foreign technology and establishing global leadership in key industries. The market responded well to this change of stance from the CCP, with offshore Chinese equities as measured by the Hang Seng Index rising 15% in Q1, led by the technology sector. We are pleased to have captured some of this rally in our client portfolios and continue to favour spreading our bets on innovation, as it remains unclear who the ultimate winners will be in many high-growth industries.

As we write this letter, we are awaiting the latest announcements from President Trump on what he has dubbed Liberation Day (2nd April). I suspect this will not be the last quarterly letter we write this year that immediately becomes out-of-date as policy shifts and markets with it. This heightened volatility must naturally be met with caution by stewards of investors’ capital like us, but it is equally important to keep one’s eyes on the prize. Headlines do not generally dictate long term investment returns, but they can create opportunities to enhance them. We are therefore focusing on fundamentals, whilst keeping an eye on the news, rather than the other way around. This mindset, coupled with nimble implementation and genuinely global asset allocation, should allow us to capture opportunities presented by the ongoing rebalancing of world power.

Fred Hervey

Chief Investment Officer