We write this piece in the aftermath of a convincing victory for Donald Trump in the US presidential election, with the Republican Party also having taken control of the Senate and the House of Representatives. Financial markets had begun to move in Trump’s favour ahead of election day, reflecting an advantage for the former president that pre-election polls had seemingly failed to capture. In hindsight, even markets had not quite anticipated the extent of the former president’s popularity. With his inauguration scheduled for 20th January, we reflect on what a second Trump term may bring.

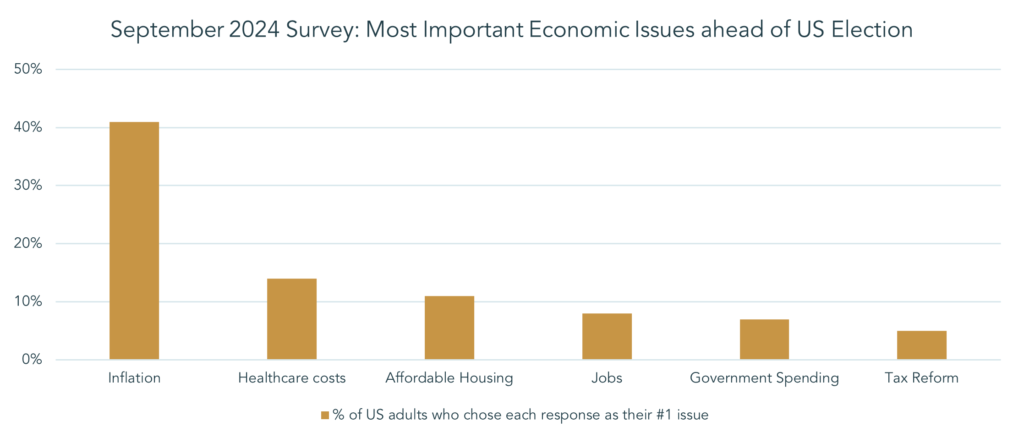

It is difficult to pin one of the most spectacular political comebacks in US history on a single factor. However, the survey data below gives an indication of the economic issues that were on the minds of American voters as they headed to the polls. The term ‘cost of living’ can broadly be used to describe voters’ priorities when choosing between Kamala Harris and Donald Trump. It seems American voters held the incumbent Democrat leadership of Biden and Harris accountable for the significant inflation they have experienced since 2020, with 41% of respondents to this survey carried out by YouGov selecting it as their top economic issue.

Source: Bankrate.com, Vanda Research, 2024

Two weeks before election day, Larry Fink, Chairman of asset management giant BlackRock, is quoted as having said at an industry conference “I’m tired of hearing this is the biggest election in your lifetime. The reality is over time it doesn’t matter”. When considering equity market returns under the last two premierships in the US, Fink’s sentiment rings somewhat true. During the last Trump presidency, the S&P 500 generated a total return of 70%. Since the start of President Biden’s tenure, the US equity index has gained a similar amount (c.80% at the time of writing). One might conclude that other forces are more important drivers for equities than politics in isolation.

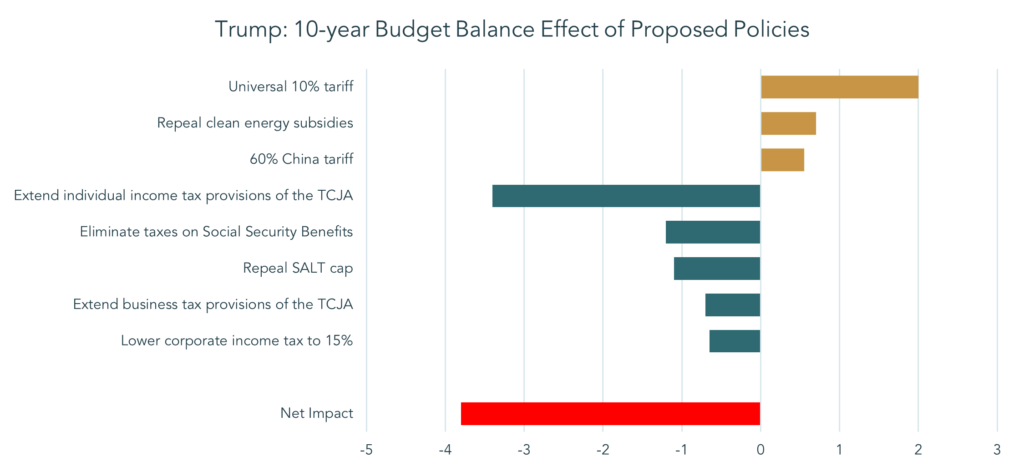

Going into the election, bond markets also saw some similarity between the two potential outcomes. Expansionary fiscal policy (the government spending more than is raised in taxes) has historically been associated with the left of American politics. Donald Trump turned this notion on its head, proposing to run a wider budget deficit than his opponent. Of course, Trump and Harris differed on the policies that would lead to this fiscal expansion, but both were expected to lead to higher government borrowing. The Republicans have proposed cutting corporation tax from 21% to as low as 15%, as well as implementing tax relief on capital expenditure. Trump is also expected to push to make the various tax-cutting provisions of the 2017 Tax Cuts and Jobs Act (TCJA) permanent. Bond yields in the US rose over the summer as markets came to terms with the reality that the political consensus in the US seemed to include a disregard for fiscal prudence.

With victory in the bag for Trump, investors are now deliberating how much of his campaign agenda will become reality. The data in the graph below was produced by strategists at J.P. Morgan to capture the major economic policies on which Trump campaigned and their impact on US government borrowing, an estimated increase of nearly $4tn.

Source: Penn Wharton Budget Model, JP Morgan Asset Management, 14 October 2024

It is, of course, quite possible that some of these proposals will be watered down in practice. We see tariffs (taxes on imports) as one area in which the reality is likely to be more nuanced than was conveyed on the campaign trail. Diluted or not, the 60% tariffs that Trump has proposed on imports from China are potentially very significant for the Chinese economy, which has recently been grappling with the collapse of its indebted property industry. Trump’s last term in office saw a major reversal of 20+ years of growth in Chinese exports to the US, as he penalised goods landing in the US from China, a hostile stance which continued under President Biden.

With Trump threatening to further up the ante, trade negotiations between the two superpowers will be pivotal for the global economy and geo-politics. With tariffs having been proven to effectively curtail the growth of US imports from China and the Chinese economy in a weaker position than it was when Trump came to power 8 years ago, one might expect concessions from Beijing in order to avoid the most punitive outcomes. On the other hand, there are those who argue that Chinese policymakers are unlikely to make meaningful concessions, viewing Trump’s presidency as short-term pain that could bring long-term gain, as trading partners shunned by the US deepen mutually beneficial ties.

The European Union is another exporting powerhouse with which Trump will seek to level the playing field in the eyes of American voters. European equities, particularly in Germany, have lagged this year, reflecting the headwind that a Trump administration presents for Europe’s manufacturing heartlands. The threat of tariffs on European imports will likely create a good deal of uncertainty among European companies. Whether or not they are fully implemented in the end, companies might postpone their investment decisions until they have clarity, leading to slower growth in the region as a result. Having said that, from an equity investor’s perspective, we note that a good deal of the bad news is already reflected in the very cheap valuations of many European companies.

As well as expecting the issuance of more debt, yields on US treasuries have moved higher on the election result in anticipation of higher inflation, somewhat ironically in the context of issues that voters were worried about. At least in the short term, the market perceives that tariffs on imports will feed into higher prices paid by US consumers on affected goods and services. In the longer term, the effects are less clear-cut. Artificially high prices could have the effect of destroying demand for a given product (even if there is a higher likelihood that it is produced domestically), which would have a deflationary effect on consumer prices. Furthermore, tariffs have the effect of strengthening the US dollar since fewer dollars leave the US to buy foreign goods. This is another potentially deflationary force in the long run, although Trump has said that he does not want to see a strong dollar. Time will tell whether he can achieve the low inflation, high growth and weak dollar combination that he is seeking to engineer.

Curbing immigration was another key pillar of Trump’s campaign. A reduction in the supply of labour from abroad would tighten the labour market, adding to upward pressure on wages. With wage-driven service sectors continuing to produce inflation above the Federal Reserve’s 2% target, thereby limiting the scope for the central bank to cut interest rates, interventions on immigration are part of the bond market’s upwards shift in interest rate expectations for the coming years.

Deregulation is also likely to be a theme of Trump’s second term. Oil and natural gas producers are likely to see red tape slashed, despite US oil production running at record highs. It is likely that Trump will lift the pause on new natural gas permits introduced by his predecessor and may accelerate approval timelines in the sector. The consequent increase in oil and gas supply could be a drag on energy prices whilst also having the potential to benefit inflation data to some degree. By contrast, renewable energy is seen as one of the big losers from Trump’s victory, with certain companies set to suffer if clean-energy tax credits are withdrawn as has been touted in Republican circles. Elsewhere, the finance industry is also likely to benefit from a more relaxed regulatory environment, as well as pharmaceuticals and biotechnology where we expect to see a streamlining of the approval process for new treatments.

With an ostensibly pro-growth agenda, it is easy to see interest rates remaining at a structurally higher level in the next four years than we saw during Trump’s last term, when the federal funds rate averaged 1.3%. With various policies at risk of stoking inflation, there has been increased speculation regarding the ability of the Federal Reserve to maintain its independence under a Trump presidency. Despite having appointed the current Fed Chair, Trump has since repeatedly expressed his disapproval of Jerome Powell, particularly his decision to raise interest rates to the relatively high levels we see today. Despite Trump’s belligerent rhetoric, it would be quite difficult in practice for him to oust Powell before May 2026, when the Fed Chair comes up for re-appointment. But there are ways in which Trump could influence policy, such as undermining Powell’s authority by announcing his choice of a more dovish successor. Any success on this front could lead bond yields to rise, as a bias towards lower interest rates would be conducive to higher growth and inflation.

Trump’s desire for lower interest rates is linked to his desire for a weaker US dollar. With a revival of US manufacturing a key promise to his voters, dollar strength on the back of higher interest rates would be an unhelpful headwind to the international competitiveness of these industries. If he is unable to engineer growth without inflation through deregulation and tax cuts, he may still get his dollar wish by less desirable means. The dollar’s status as the reserve currency of the world relies on a stable market for Treasury bonds. If Trump were to stretch the budget deficit too far, we may see the bond market spooked in a moment of fiscal reckoning.

A hostile approach to international relations also risks intensifying some forces which have the potential to undermine the dollar. The strong performance of gold in recent years has been driven in part by stockpiling from central banks, particularly in emerging markets, who have sought to diversify their reserves by holding fewer dollar assets, making them less beholden to US demands. At the recent BRICS summit for emerging market leaders, Russia laid out a proposal for a unified depository and clearance system for payments between BRICS economies. Whilst there remain hurdles to the widespread adoption of this payment infrastructure, its discussion in this forum may portend the direction of travel. This may give Trump the weaker dollar he wants, but less influence on global affairs strikes us as a high price to pay for it.

Pulling these competing forces together results in a complex macroeconomic outlook. One point we would stress is that Trump will take office with the economy in a very different state to the one he inherited in 2017. We are therefore cautious of blindly following the investment playbook which worked last time around. Nonetheless, where we have conviction, we are not shy of capitalising on the investment opportunities that Trump’s arrival in the White House presents. We see his economic policy overall as supportive for smaller US companies, particularly those equities able to cope with higher interest rates. Elsewhere, we note sectors such as biotechnology, where an easing regulatory environment may combine with other secular drivers to produce attractive returns from here. One thing we will keep from last time around is our nimble approach to implementation. This should prove valuable as we acclimatise to Trump 2.0.

Lincoln Private Investment Office

This document has been prepared and distributed for information by Lincoln Private Investment Office LLP (“LPIO”) and is a marketing communication. LPIO is authorised and regulated by the Financial Conduct Authority. The information in this document does not constitute an offer by LPIO to enter into a contract/agreement, nor is it a solicitation to buy or sell any investment. Nothing in this document should be deemed to constitute the provision of financial, investment or other professional advice in any way