“As long as the dollar remains in high esteem as a trade currency, America can continue to spend more than it earns. But when the day arrives – as it certainly must – when the dollar tumbles and foreigners no longer want it, the free ride will be over.”

G. Edward Griffin

In recent years the supposedly quieter summer months have brought with them some significant choppiness in financial markets, exacerbated by lower levels of liquidity. The past quarter was no exception, with a monetary policy surprise in Japan and weak US inflation data triggering a volatility spike in early August. A seemingly benign quarter in markets (global equities rose 6% over the period) hides complexity beneath the surface, providing plenty for investors to consider. As far as new information goes, a new candidate for President of the United States coming into strong contention is certainly up there, so let us start with that.

The televised debate we touched on last quarter proved to be the straw that broke the camel’s back for President Biden’s re-election campaign. He stepped aside in July to be replaced by his Vice-President, Kamala Harris, as the Democrat nominee for the 2024 US election. Billed as having low levels of popularity before her nomination, Harris has succeeded in paring back Donald Trump’s lead in the polls, setting up November’s election to go down to the wire. We are not inclined to speculate on binary outcomes in our letters or in our investments, particularly where the probabilities look finely balanced. However, we would note a few things which feature more prominently in our thinking as long term investors.

For all the momentum in her campaign, bolstered by some effective public appearances, Vice-President Harris has so far given away relatively little by way of policy, particularly relating to the economy. Whichever candidate secures the keys to the White House, fiscal restraint looks to be low down the priority list. To maintain its aggressive budget deficit, the US will need to continue to issue significant levels of debt, likely adding upwards pressure on US government bond yields over the coming years. Harris has, however, expressed a desire to increase tax revenue, without laying out full details. Her rhetoric so far suggests that higher taxes are likely for both corporations and wealthy individuals in the event of her election, both of which have the potential to slow economic growth. In this context, she could be considered marginally more fiscally conservative than her opponent, who will likely pursue growth in a more aggressive manner.

In the event of a win for Donald Trump, his protectionist intentions have been made clear. The range of tariffs he has proposed on imports into the US are much more punitive than those imposed when he was previously in office and carry a high risk of stoking domestic inflation. They would also act as a headwind for the countries and companies exporting these goods. Media attention focuses on emerging markets, with China and Mexico likely to be in Trump’s crosshairs for obvious reasons. Equally profound but perhaps less well-telegraphed is the Republican leadership’s hostile stance towards Europe. Already under threat from Chinese competition, Europe’s manufacturing heartlands would likely suffer a further setback under a Trump administration. We also note that the electoral calculus is such that if Trump were to win in November, there is a good chance that the Republican Party would take control of both chambers of Congress too. This would give Trump a platform to enact policy swiftly and decisively.

Whilst politics inevitably dominates the headlines, the actions of major central banks are just as important. It is interesting, therefore, to see divergent policy and guidance emerging from these influential institutions. This is something that markets have rarely had to grapple with since the Global Financial Crisis in 2008, which saw central banks across developed markets loosen policy in lockstep, a synchronised manoeuvre they repeated in response to the Covid-19 pandemic. This quarter, subtle differences between monetary policy in different regions intensified. September saw the Federal Reserve (the Fed) cut its policy rate by 0.50%. This is twice the usual increment of 0.25% and suggests it is mindful of some weakness in the US economy, despite its apparent strength on many metrics. Meanwhile, earlier in the quarter, markets were surprised by the Bank of Japan (BoJ) hiking interest rates for only the second time in 17 years. After decades of stagnation, the Japanese economy has been generating higher growth and inflation in recent months. With wage inflation gathering momentum, the direction of travel for Japanese monetary policy looks different to other developed markets, particularly the US.

Between the opposing actions of the BoJ and the Fed are a range of nuanced policy stances from other major central banks. Both the Bank of England and the European Central Bank have cut interest rates marginally from their highs, but officials in Frankfurt look more inclined to continue easing monetary policy than their counterparts in London, with the Bank of England retaining relatively restrictive interest rates at September’s meeting. This dispersion in monetary policy, driven ultimately by the differing performance of economies in different regions, is an excellent environment for the actively managed portfolios that we run for our clients. The ability to invest in multiple asset classes, including commodities, as part of our approach is also advantageous in these conditions.

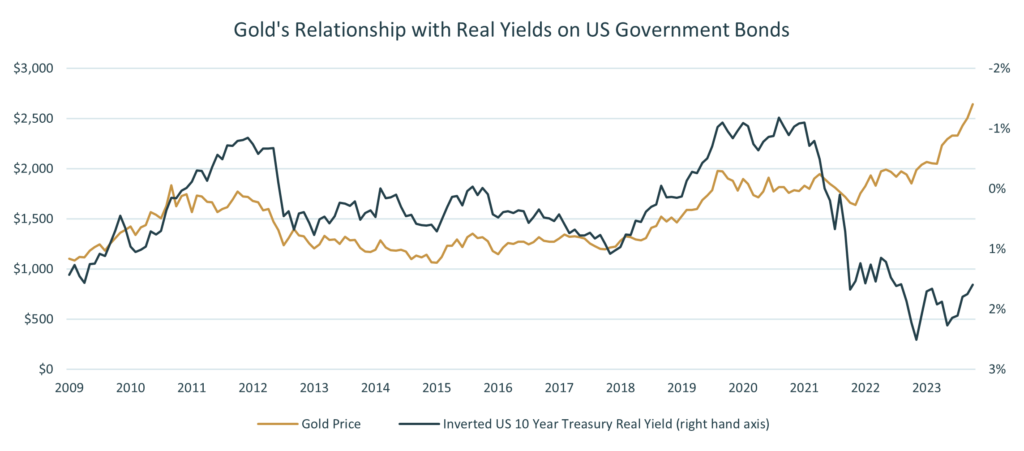

A commodity we have favoured for some time is gold, the price of which has risen 29% this year and finished the quarter close to all-time highs. Historically, gold has benefitted from falling real yields (the return on a bond after accounting for expected inflation). Essentially, when the prospective returns from comparable ‘safe haven’ assets like government bonds fall, the opportunity cost of investing in gold also falls, making it a more attractive investment. This relationship is shown in the graph below.

Source: Bloomberg LLP, 2004

It can be seen above that the decline in bond yields from their peak in April has given gold a boost. Its performance in recent years has also been driven by the more secular force of stockpiling by central banks across the world, with the World Gold Council reporting 483 tonnes of buying in the first half of 2024, the highest since records began. Emerging market banks have dominated the list of buyers in recent years, seemingly incentivised in the wake of sanctions on Russia to hold their reserves in a form which the US government can less easily intervene with. This buying pressure helped gold to sustain its uptrend even whilst real yields were rising through 2022 and 2023.

Gold also generally performs well in an environment where the US dollar is weakening, since the value of the metal is priced in dollars and thus benefits from an inverse relationship to the currency. The upswing in the gold price in September certainly coincided with some weakness in the dollar which would be a supportive force if it were to continue. With interest rates in the US likely on a downwards trajectory, there is reason to believe that the dollar strength that has been a feature of financial markets since 2008 may be due for a period of reversion. The Japanese yen has suffered considerably at the expense of the dollar over this period, but with the central banks in these two countries pointing in different directions, Q3 saw the yen regain some significant ground which we believe can continue.

With the Fed’s larger rate cut weakening the dollar, officials in China were presented with an opportunity to intervene more aggressively in their sluggish economy without being accused of currency manipulation. The People’s Bank of China (PBOC) implemented additional interest rate cuts in September, as well as encouraging banks to increase lending by cutting their regulatory reserve requirements. The PBOC went further, allocating ¥700bn to purchases of Chinese equities in a bid to shore up the local stock market, alongside which the Chinese government pledged fiscal stimulus for the economy. Chinese equities surged on the news, having been languishing thanks to poor sentiment on the economy since 2021.

Although Chinese equities were the most obvious beneficiaries, global assets with sensitivity to the Chinese economy also rebounded, most notably commodities. With China accounting for >50% of the world’s refined copper demand, hope that the economy may be regaining momentum saw the metal gain 10% in September. In our view, opportunities for investors in Asia are not confined to China. In South Korea, corporate governance reforms are unlocking value embedded in the country’s equity market, while in the fast-growing economies of southern Asia, investors are offered an attractive combination of favourable demographics, strong government finances and under-valued domestic currencies. Against this backdrop, household wealth is being created rapidly, leading us to favour consumer-facing companies in this region.

The flagship index of the world’s largest equity market, the S&P 500, tells an interesting story of Q3. 394 of its 500 constituents delivered a positive return in the quarter, contributing to its 5.4% overall return. Importantly, the index’s largest companies, which had driven returns in the first half of the year, featured in the minority of negative performers, illustrating the healthy broadening out of returns that is taking place in the equity market. We believe this broadening has further to run, not just within the US, but across global equities. Our portfolios are very well-placed to reap the rewards in this scenario.