“I don’t know if war is always pointless,’ she said. ‘I know it’s always tragic.”

Catherine Ryan Hyde

Financial markets were unsettled this quarter by the deeply saddening events in Ukraine which have dominated the news over the last six weeks. Emerging Market, Asian and European equities were among the worst performers, whilst markets with high commodity exposure such as the FTSE 100 held up relatively well. Our unconventional positioning in fixed income allowed us to avoid the substantial losses in traditional bond markets this year, with the asset class failing to provide shelter during a turbulent quarter. In this letter, we discuss the economic ramifications of the conflict and its likely impact on our portfolios, as well as looking at other influences on investment performance, most notably inflation.

Stubbornly high inflation has forced central banks off the sidelines this quarter in order to bring rising prices under control. Such was the change of rhetoric from central bankers around the world that bond markets over the course of the quarter went from pricing two interest rate hikes from the US Federal Reserve in 2022 to eight. Similar action is expected from many other key central banks including the Bank of England. We have seen significant capital losses in conventional bonds as yields have risen, with the Bloomberg Global Bond Index declining 6.2% in Q1, the worst quarter on record. Even index-linked UK government bonds, which have cashflows tied to the inflation rate, lost 5.1% in the quarter.

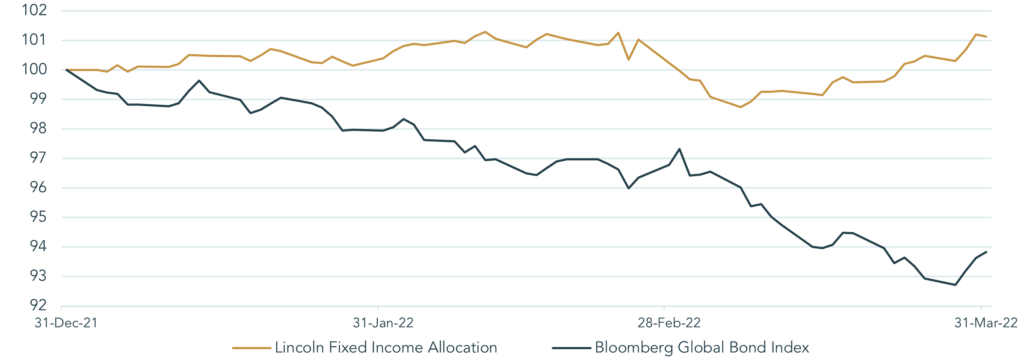

Our positioning in the fixed income asset class has been deliberately unconventional for some time in anticipation of rising interest rates. As can be seen on the chart below, the fixed income component of our core portfolio held up considerably better than the broader fixed income markets this quarter. Indeed, our alternative stance has delivered material outperformance of the wider bond market over the past 12 months as bond yields have trended higher.

Lincoln Fixed Income Allocation versus Global Bond Index: Q1 2022

Source: Bloomberg LLP, 2022

Despite the losses in the rear-view mirror, the outlook for traditional bond markets continues to look challenging. Inflation data became progressively more extreme as we moved through Q1, with prices in the US rising 7.9% year-on-year in March, a 39-year high. The Eurozone saw a 5.0% annual price increase in March, the largest increase since the bloc’s inception. Whilst we expect to see these figures tempered in future months as some ‘one-off’ factors wash through the numbers, inflation at these levels is materially above central bank targets, which are set at optimum levels for economic growth. Central banks have no choice but to embark on monetary tightening programmes, raising interest rates and withdrawing stimulus from bond markets in order to prevent the current inflationary pressures from becoming entrenched in the system. Whilst we may see moments of recovery, the trajectory appears to be negative for traditional bond markets for the time being.

Another feature of the first quarter was substantial losses in expensively valued growth equities. The explanation for these declines is that, with inflation and interest rates on the rise, the value of potential future profits in these companies to present-day shareholders is eroded. This relationship has the greatest effect on companies that are not yet profitable, as their value is derived from cashflows expected further in the future. The NASDAQ index, which contains a number of such companies, lost 8.5% in January alone and finished the quarter with losses of 9.1%. We will continue to focus our investment strategy on profitable companies with sound fundamentals to protect against this effect.

Looking at market snapshots at the end of a quarter can disguise a great deal about the events of the intervening period and this quarter is no exception. On 24th February, the Russian Federation shocked the world by invading Ukraine, a sovereign European country. No doubt you are all too familiar with the horrific events that have taken place since. Among the implications for Europe is the largest refugee crisis since the Second World War, with over 4 million refugees having fled Ukraine and more than a quarter of the Ukrainian population displaced by the conflict. In the early days of the invasion, the rising yield trend of 2022 took a significant pause for breath, as the outbreak of a war in Europe caused investors to rush to the perceived safety of government bonds. However, as investors realised that inflation was likely to rise, the market concluded that government bonds would be unlikely to provide much protection and bond yields resumed their upward trend. Meanwhile, in a volatile period for equities, trading was halted on the Russian stock market and it continues to be closed to foreign investors as a result of Western sanctions on Russian financial assets.

Russia is a relatively small economy, representing less than 2% of global economic output. Nonetheless, the country is critical in the production of certain raw materials. It is the world’s largest producer of wheat and palladium, the second largest producer of gas, the third largest producer of nickel and gold, as well as producing 10% of the world’s oil. With the supply of these resources and others likely to be restricted either by the conflict or by sanctions, we have seen substantial price increases in many commodity markets. As a result, the Bloomberg Global Commodity Index, a weighted index of industrial and energy commodities, gained 25% over the course of the quarter.

The war has exposed crucial imbalances that have accumulated over time. Unfortunately, many of the imbalances that have boiled over this year are within industries of prime necessity such as raw materials, food, chemicals, fertilisers and energy. Supply squeezes in these industries will be inflationary over the medium term. We have made adjustments to our portfolios to reflect the new status quo, notably reducing some of our more cyclical exposures in Europe and increasing allocations to economies with more energy self-sufficiency such as the US. Broadly, though, our portfolios remain positioned for an environment of higher interest rates and elevated inflation levels compared with recent history.

It is important, however, to caution against extrapolating today’s events into the future. Whilst inflation is clearly a concern, we believe the energy component is unlikely to continue to trend upwards with the same steepness. On the demand side, we note that inflation can itself be demand-destructive. Price rises to date may erode what is currently considered to be a strong demand side of the inflation equation by inducing a change in consumer behaviour. If demand were to soften, the inflation picture would also cool considerably. Moreover, there is of course the possibility that interest rate hikes by key central banks will be effective in taming inflation. For these reasons, a balanced and proportionate response to the inflation challenge is necessary in portfolio construction.

Recent developments in Europe are undoubtedly a headwind for the global economy, with some technical indicators in bond markets implying an increased probability of a recession, although these indicators are not always reliable. The depth and duration of any potential economic contraction will depend on the global response to Russia’s actions. Central banks will also need to tread carefully with policy adjustments, as their attempts to tame inflation could have unintended consequences for economic growth. However, looking beyond the near term, the conflict may perversely have some constructive effects on the economy. Numerous governments have pledged significant capital expenditure on energy security, renewable energy and military infrastructure. These fiscal programmes will serve as a tailwind for the companies involved in these supply chains.

The consequences of this quarter’s events, both political and financial, are still very much in their infancy. True enough, some repercussions such as inflation are already becoming evident. But it will be years before the ultimate consequences can be observed. The US Dollar, for example, having been weaponised as a sanction tool, may see its status as the reserve currency of the world undermined by emerging global powers who wish to avoid the financial punishment that Russia has experienced. We will continue to look for these structural changes and the opportunities they present, whilst keeping a watchful eye on what could be a bumpier road ahead in the short term.