“Winning or losing of the election is less important than strengthening the country.”

Indira Gandhi

The third quarter in markets was characterised by a shift in focus from inflation to growth. Inflation data in developed markets, whilst still elevated, showed some signs of easing from extremely high levels. With this trend accompanied by surprisingly strong economic activity and a pause in interest rate hikes by key central banks, markets initially drew the conclusion that the global economy was destined for a goldilocks scenario in which inflation falls with little impact on growth. However, later in the quarter, leading indicators began to show cooling activity in parts of the economy, whilst rising energy prices served as a reminder that some inflationary forces are out of central bankers’ control. Politics is another force central banks cannot influence. With 3.1 billion citizens set to go to the polls in 2024, representing 40% of the world’s population, 60% of the global economy and 80% of equity market value, we go on to discuss global politics in more detail than usual. First, we reflect on a key market narrative in September.

As we left summer behind, markets became increasingly preoccupied with the ascent in the price of oil, with Brent crude posting a 28% gain over the quarter, closing at just over $95 per barrel. The move was driven by a combination of surprisingly strong economic activity and supply cuts by major oil producers, most notably an extension of voluntary supply cuts by Saudi Arabia until the end of this year. With slowing inflation giving US and UK central banks the confidence to pause their rate hiking programme, this rebound in oil prices could be problematic. Whilst it is true that central banks tend to focus on core inflation data from which direct energy costs are excluded when setting interest rates, oil prices have a unique ability to pervade the economy, pushing up costs for nearly all businesses and households. Workers and their unions are agnostic about the cause of inflation when demanding pay rises and inflation of any sort can trigger the spiralling feedback loop between prices and wages.

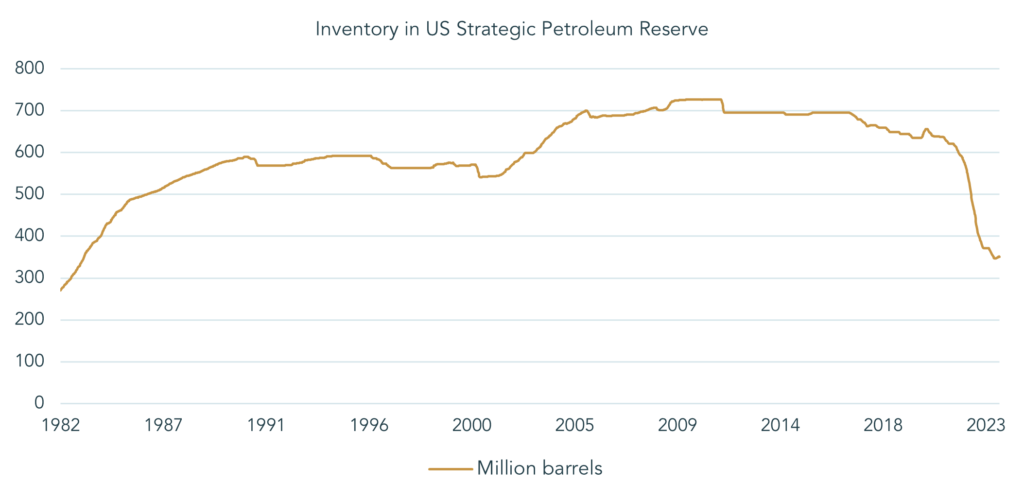

With its impact on living standards, inflation is of course just as important to politicians as central bankers, evidenced by the measures President Biden has taken to contain it in the US. Perhaps most strikingly, given what has happened with oil prices this quarter, Biden has depleted his country’s Strategic Petroleum Reserve to its lowest level in 40 years in response to rising energy costs, as shown in the graph below. With just over a year left until the next US presidential election, he has used most of the ammunition in one of his key inflation-fighting weapons, putting major oil exporting countries in a particularly strong negotiating position with the incumbent Democrat regime. As a result, US relations with major oil exporters such as Saudi Arabia and Venezuela will be in focus, especially given the strain we have seen on these relationships in recent years.

Source: Bloomberg LLP, 2023

Latest polling suggests that next year’s presidential election will be tighter than President Biden would like. Whilst there is little he can do to influence the legal proceedings surrounding Donald Trump and the rallying cry these court cases represent for his supporters, the President will likely do all he can to tip the economic scales in his favour. The last three one-term presidents (Jimmy Carter, George H.W. Bush and Donald Trump) all had their re-election hopes dashed by a recession. It will no doubt be a concern, therefore, that 55% of Wall Street economists polled by Bloomberg expect a US recession in the next 12 months. Biden will endeavour to keep economic momentum going into election day, so we expect to see more instances of narrowly avoided federal government shutdowns as Democrats stretch the national balance sheet to its limit. To maintain its fiscal deficit, the US will need to continue its significant issuance of government bonds which is likely to put continued upward pressure on US bond yields.

Arguably just as important geo-politically, but enjoying far less UK press coverage, is the Taiwanese presidential election scheduled for January 2024. China’s leaders hope former New Taipei City mayor Hou Yu-ih, candidate of the Kuomintang opposition party, will emerge victorious, but polling indicates a lead for the current Vice President William Lai, who is standing for the incumbent Democratic Progressive Party (DPP). The DPP favours a tougher approach to Beijing which may invite increased hostility from China in the event of a Lai victory. At this stage, however, China looks to be leaving its options open. In the same month as China’s navy conducted its largest ever military exercises in the western Pacific, Beijing also announced details of a plan to encourage integrated economic development between China’s Fujian province and Taiwan. Taiwan is clearly of huge strategic and cultural significance to the world’s second largest economy and consequently this election warrants the attention of investors, albeit a continuation of the status quo looks most likely.

Next year’s largest election by number of voters will take place in India. Indian equities have been standout performers recently, returning 12% since the start of 2022 whilst global equities have lost 8%. The investment opportunity presented by India’s rapidly growing population has been clear for many years. However, the country required significant reforms to unlock this potential, including changes to its institutions, education, healthcare and employment. Under Prime Minister Modi’s stewardship, India has made significant progress in these areas, putting its economy on a strong footing, certainly relative to its peers. Companies have flourished as a result, with their equities producing substantial returns from which our portfolios have benefitted. Consequently, we took note when Modi’s BJP party suffered a setback in May, losing the state of Karnataka to the Indian National Congress in a local election. Karnataka is one of India’s wealthiest states and home to the technology hub of Bengaluru. Ahead of the general election in May, investors will want reassurance that stability for businesses will be maintained. If this is achieved, the Indian equity story may only just be beginning.

Another market in which we are hoping for some stability is the UK. Manifestos are being hashed out at the time of writing, but environmental policy is one area on which the major parties are already establishing key differences, with significant ramifications for investment in green energy supply chains. As we approach election day, which is yet to be set, the distinctions between incumbent Sunak and poll-leader Starmer are likely to crystallise. However, at this stage, it looks as though the attitudes of the major parties towards fiscal policy is likely to be similar, which should mean that bond yields in the UK are somewhat rangebound in their response to the political landscape.

The danger of discussing politics in an investment context is that one’s own views on the outcomes can encourage a degree of short-termism into an investment strategy. The reality is that speculating on binary political events is very difficult to execute. What has historically proven to be a more reliable way of generating outperformance is being mindful of the valuation of investments held in a portfolio. With markets taking time to adjust to the economic reality we find ourselves in, valuation inconsistencies are presenting huge opportunities for active fund managers to add value. This will only increase if political change creates heightened volatility. With the busy calendar ahead, we are comforted by the discipline built into our investment process, as well as the fund managers in our portfolios. We are confident in their ability to navigate the next year and beyond.