“Innovation and corporate governance are extremely important to improve the profitability of Japanese companies and encourage them to increase wages, capital spending, and dividends.” Shinzo Abe, former

Prime Minister of Japan

If markets in 2022 were characterised by synchronised falls in asset values, then the year so far could be characterised as one of desynchronisation. The second quarter saw some particularly pronounced divergence in the behaviour of different asset classes which challenged the conventional toolkit for multi-asset investors. In what follows, we examine these disparities and reflect on the conflicting economic narratives told by different regions and asset classes.

We have been arguing for some time that interest rates would not come down as quickly as the market was hoping for. Whilst it is too early to say for sure, our view, dubbed by some as ‘higher for longer’, is starting to be adopted as consensus. At the start of the quarter, the US interest rate was projected to be 4.3% at the end of 2023. Three months later, the market now expects a federal funds rate of 5.4% at the year-end. We also saw longer-term borrowing costs rise in the quarter, with the US 10-year Treasury bond yield climbing from 3.5% to 3.8%. Long-term bond yields are particularly influential on equity valuations since a higher yield increases the discount rate applied to a company’s future profits, reducing their present value. It is somewhat surprising, therefore, that despite this inverse relationship between bond yields and equity values, many equity indices followed up strong returns in Q1 with further gains in Q2, led by the S&P 500 index in the US with 8.3%. It appears that bond and equity investors are interpreting the current environment rather differently.

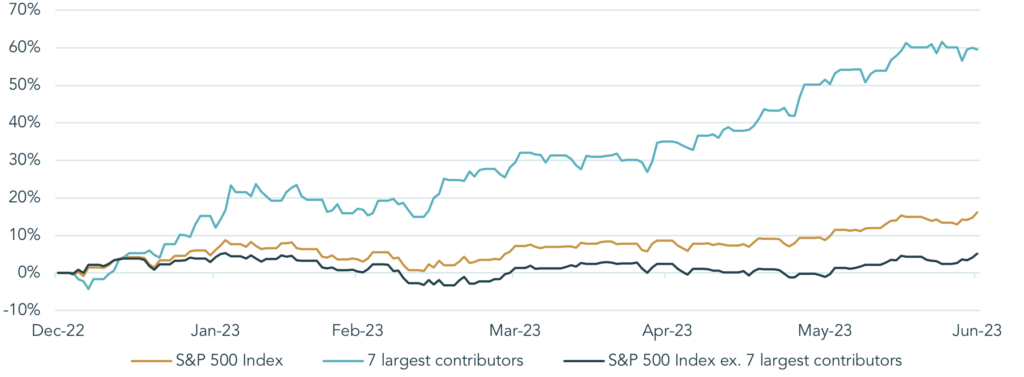

A closer look at the contributors to equity index performance in the US reveals that equities are not all singing from the same hymn sheet. Returns in the first half of this year have been disproportionately skewed towards a handful of large US technology companies. In fact, if you removed the performance of the 7 top technology stocks, the S&P 500 index would have returned 5% in the first half, rather than the 16% it achieved with the contribution from these 7 companies. This divergent performance (shown below) has left the US equity market at its most concentrated level in history, with the largest 10 stocks accounting for >30% of the value of the S&P 500 index. This lack of breadth has been characteristic of index returns in Europe this year too.

S&P 500 Index Returns Year-to-Date

Source: Bloomberg LLP, 2023

The equity performance of large technology companies has been driven by investor excitement about artificial intelligence (AI). The term covers many technologies which combine computer science and data to enable problem solving akin to that carried out by humans. With its potential to deliver substantial productivity gains, investors have sought out companies that they believe offer the best exposure to this theme, propelling their valuations higher in anticipation of substantial future profits. AI does indeed have potentially transformative applications in certain industries, although it is generally accepted that the technology’s benefits will take time to harness. Once it has been refined, we see the benefits of AI accruing to a broad range of companies.

Absent this bullish AI sentiment, equity markets have not had much to cheer about, with monetary conditions likely to get worse before they get better. Fed Chair Jerome Powell argued at a recent conference in Portugal that hopes for imminent rate cuts in the US were misplaced. If the Fed follows through on this guidance, we should see yields on near-term government bonds at or around current levels for some time. Furthermore, with President Biden having negotiated an increase in the Treasury Department’s debt ceiling in June, we expect to see a flood of government bond issuance later this year. This increased supply of bonds, projected to exceed $1tn, should keep upwards pressure on US government bond yields, as investors demand higher returns in exchange for their loans to the US government. The chances of a near-term sugar-rush to support equity valuations in the form of easy money are therefore slim. With the past year’s monetary tightening feeding into the economy gradually, we believe the parts of the equity market where valuations have become extended are not reflecting the tougher operating environment for companies from here.

The UK is perceived by international investors to sit at the epicentre of this tougher environment. With a strong labour market and stubbornly persistent supply issues, the UK’s inflation is not falling as quickly as its peers’. As a result, the Bank of England is expected to tighten monetary policy further from here. We saw evidence of this in June, with the Bank delivering a ‘double’ increase to the base rate of 0.50%, following a series of hot inflation data releases. The impact of these tighter conditions is most palpable in the mortgage market, with affordability receiving a great deal of press coverage. The UK economy is particularly sensitive to short-term interest rates since, according to JP Morgan estimates, 60% of mortgages are due to be re-financed in the next 18 months. We think the market’s expectation of significant further interest rate hikes may be failing to account for this and we are inclined to think that the central bank’s ability to raise rates much further is limited. With much of the bad news fully reflected in valuations, the negative sentiment surrounding UK assets is presenting investment opportunities in both bonds and equities. It is important to remember that the UK equity market, particularly the FTSE 100, consists of a truly global mix of companies and their valuations sit well below the historic average.

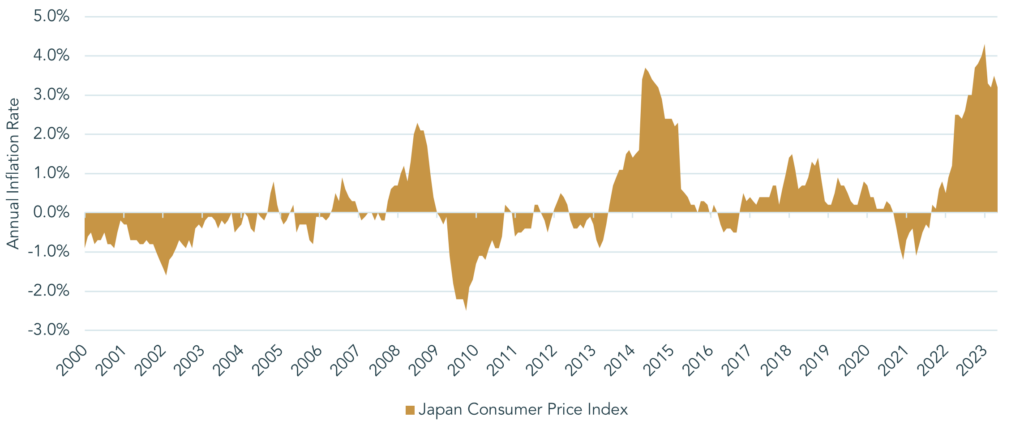

Ironically, given the monetary firefighting taking place in other developed markets, inflation is seen as a positive story for Japan. The country has suffered over two decades of feeble growth and anaemic inflation, frequently seeing periods of negative inflation as shown in the graph below. Just as inflation can become self-perpetuating, deflation can also become deeply embedded in the economy, as falling prices encourage thrift which compounds the problem of falling prices. For this reason, far from shying away from it, Japan’s policymakers are trying to encourage the current demand-led inflation to continue in a sustainable fashion. With a severe labour shortage caused by the country’s elderly population, there is every chance that today’s inflation could continue. Well-managed, rising prices should contribute to revenue growth for Japanese companies, many of which already find themselves in rude financial health. This is an exciting prospect for shareholders.

Inflation History in Japan

Source: Japan Ministry of Internal Affairs & Communications, 2023

The world is starting to appreciate the opportunity in Japan, with local equities rallying 14% in Q2 on the back of inflows from abroad. Japan has piqued the interest of international investors, including Warren Buffet, because its equities are cheap, and clear catalysts have emerged that should improve their valuation. Among these is a rule introduced by the Tokyo Stock Exchange in January that requires companies with an equity valuation lower than the accounting value of their net assets (book value) to disclose a plan to improve their valuation. It may not sound significant, but approximately 50% of Japanese equities trade below their book value. This new intervention, along with prior supportive regulations, are encouraging many companies to pay more attention to their shareholders, something that Japanese corporations have historically struggled with. Share buybacks are one tool with which companies can reward shareholders and improve the valuation of their equity. The value of such buybacks hit an all-time high last year and are on track to do so again this year, suggesting that the shareholder-friendly changes in Japan’s regulatory backdrop are having the desired effect.

In the current challenging market conditions, we are pleased to have numerous attractive investments for our client portfolios, many of which are only accessible to those with a benchmark-agnostic approach to investing. By pursuing this approach, we are also able to avoid certain investments that others may feel compelled to own, if we believe there to be disproportionate risk associated with them. Periods of dispersed investment outcomes are valuable for active investment managers. During these times, it is important to hold one’s nerve and stay focused on investments that will stand the test of time.