“Semiconductors are the silent driver of all the advancements in the digital world.”

Morris Chang, founder of TSMC

The second quarter was a tale of two halves, particularly in equity markets. Until mid-May, with investor sentiment buoyed by the prospect of cooling inflation and resilient growth, we saw a healthy broadening of equity market performance to companies and regions outside the handful of large US companies that had dominated returns in Q1. This trend reversed from May onwards, with equity market momentum becoming concentrated once again in a small number of companies. Among the factors driving this reversal was the exceptional earnings growth seen by certain technology companies exposed to the artificial intelligence industry, which the market took comfort in as inflation concerns in the real economy resurfaced. In this letter, we go on to explore this theme and our preferred ways of gaining exposure to it, before reviewing some of the political events that took centre stage as the quarter ended.

Artificial intelligence (AI) refers to the ability of computers and machines to simulate human intelligence and problem-solving capabilities. The explosion of activity in the domain of AI has led investors to focus a significant amount of attention on a Californian company called Nvidia, originally known for making computer chips known as Graphics Processing Units (GPUs), used in the rendering of computer games amongst other things. In 2006, researchers at Stanford University discovered that GPUs could be used to accelerate maths calculations in a way that regular processing chips could not. As the use of GPUs in machine learning has grown, Nvidia has managed to corner the market for this particular application. A combination of substantial demand growth and Nvidia’s dominant market position propelled the company to briefly become the world’s most valuable corporation in mid-June, before settling at a market value of $3trn at the quarter-end, having been valued at just $1trn one year ago.

The excitement surrounding AI that has buoyed Nvidia’s shares has also extended to other industries and companies, especially those involved in supplying the proverbial ‘picks and shovels’ to the industry. Nvidia does not manufacture its own GPUs, relying instead on a Taiwanese company called TSMC, the world’s most advanced chip manufacturer. TSMC in turn relies on machines built by Dutch company ASML, which are necessary for the production of the world’s most advanced computer chips. Both ASML and TSMC have enjoyed a good run of share price performance as AI has bolstered demand for their respective products. These entwined corporate fortunes underscore the global nature of the technology supply chain, which extends right back to the metals which need to be mined to support the AI boom and other technological advancements.

At Lincoln, we believe our truly global investment approach puts us in a strong position to gain access to the most attractive parts of technology supply chains, including direct beneficiaries of the AI theme. For example, our managers in Asia have identified three sub-sectors that look particularly interesting in relation to AI. The first is IT consultancies who will advise and implement AI strategies for a range of corporate clients. The second is enablers of the physical infrastructure required to run the technology, such as the data centres in which the vast computing power is housed. The final sector is one in which Asian markets are particularly strong, namely semiconductors. Alongside TSMC, companies such as SK Hynix and Samsung Electronics are positioned to dominate the foundry of advanced computer chips. TSMC is the largest contract chipmaker in the world, whilst SK Hynix and Samsung are suppliers of high-bandwidth memory. These companies each occupy integral positions in the supply chain, meaning they will be sure beneficiaries no matter which company develops the next iteration of AI or designs the next semiconductor to power it.

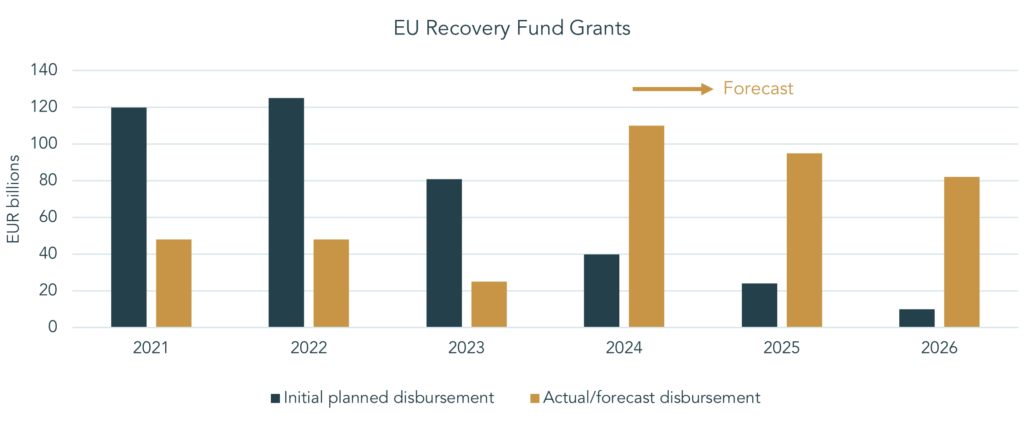

By contrast to the well-documented potential impacts of AI, we think the ramifications of the EU Recovery Fund for the region’s economy have flown somewhat under the radar. The scheme is a ratified fiscal package designed to accelerate Europe’s recovery from the Covid-19 pandemic. It allows the European Commission to borrow up to €750bn in the financial markets to distribute to member states, primarily for investment projects conditional on the implementation of certain structural reforms. Approximately €390bn of this was due to be distributed in the form of grants between 2021-2023, with the remainder coming in the form of loans. We believe the analysis below from JP Morgan has not received sufficient attention from market participants. The chart shows that the planned disbursements from the Fund between 2021-2023 have been delayed, with JP Morgan predicting that this fiscal boost will now take place between 2024-2026.

Source: European Commission, J.P. Morgan Asset Management, 2024

The conditional nature of these disbursements could have significant implications for productivity and growth in Europe. For example, to receive grants, Italy has had to reform its judicial processes which have often been blamed for poor capital allocation and sluggish productivity. The sums involved are also substantial, with potential grants totalling 5% of Italy’s 2021 GDP, rising to 12% when including the loans it has requested. This could provide a significant tailwind for the European economy, similar to that we have seen in the US following major fiscal stimulus. We think active equity managers in Europe will have an opportunity to select winners from this fiscal expansion.

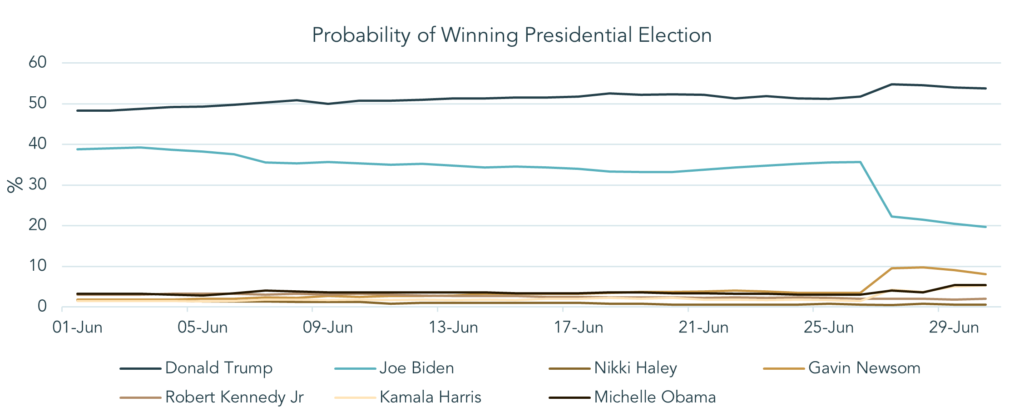

In the US, the quarter closed with a debate between incumbent President Biden and Republican nominee Donald Trump. Televised debates rarely have material investment implications, but this one has the potential to be an exception. Immediately after a disappointing performance on stage by President Biden, the probability (as implied by an average of bookmakers’ odds) of a win for Donald Trump in November’s election increased moderately from 52% to 54%. More strikingly, the probability of a Biden win fell dramatically from 36% to 20%. The reason for this unequal shift in the odds (shown below) is that polling suggests that neither Trump nor Biden are particularly popular with the US electorate, meaning that a fresh Democrat candidate could have a reasonable chance of winning. If we were to see Biden withdraw himself from the campaign, which the bookmakers are ascribing an increased probability to, it would need to happen quickly to give his replacement a fighting chance. The mechanics of this process, including the treatment of Vice President Kamala Harris who also lacks popularity, are nuanced. We will therefore be monitoring developments within the Democrat party with interest.

Source: Vanda Research Ltd, RealClearPolitics, 2024

At the time of writing, the electoral picture closer to home looks somewhat less volatile. It has been the case for some time that both pollsters and financial markets have been expecting a win for Sir Keir Starmer’s Labour Party. There is less of a consensus surrounding both the size of Labour’s majority and the composition of their parliamentary opposition. We will reserve for future letters our thoughts on these topics, as well as on the French election which is also reaching a crescendo as we write. While we wait for the dust to settle on these political transitions, we maintain our focus on long term factors we expect to underpin investment performance, some of which we have discussed here.