“Courage is willingness to take the risk once you know the odds. Optimistic overconfidence means you are taking the risk because you don’t know the odds. It’s a big difference.”

Daniel Kahneman

The year so far has seen incremental evidence pointing towards stickier inflation and correspondingly higher interest rates in the near term. We have consequently increased the probability we ascribe to this ‘higher for longer’ outcome, having written in our previous letter that it was one of the two most likely macroeconomic pathways for this year. The first quarter also saw the end of an era of unorthodox monetary policy in Japan. Before exploring this significant development, we unpick the latest data from the US economy and consider its investment implications.

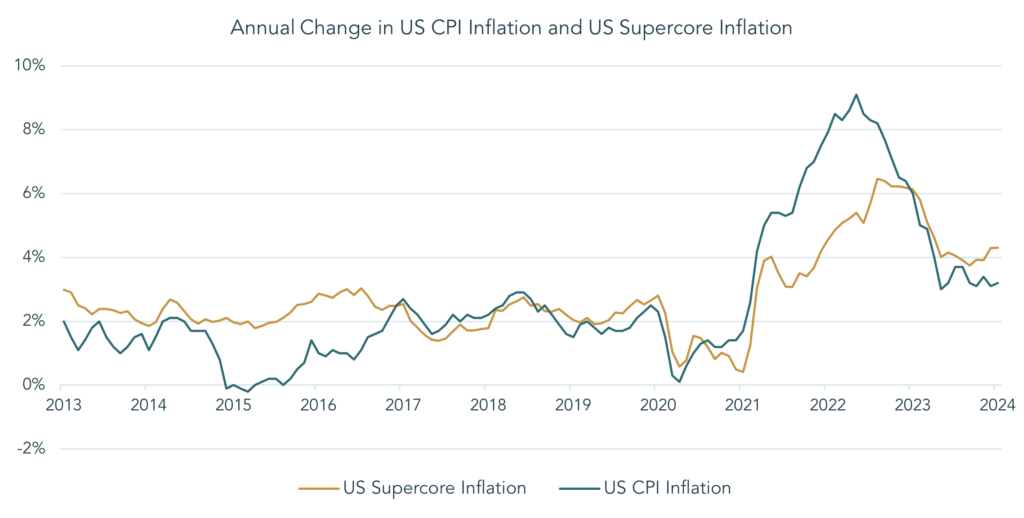

Over the course of the quarter, markets came to terms with the idea that interest rates will need to stay restrictively high for longer than previously expected. We saw robust employment and wage data from the US, demonstrating that the economy is currently coping with higher interest rates, which in turn suggests that inflation will take some time to return to the 2% level targeted by the Federal Reserve (the Fed). When assessing the underlying trends in inflation, Fed Chair Jerome Powell has referenced the importance of a metric known as supercore inflation. Supercore inflation captures price changes in service sectors whilst excluding the volatile components of the headline inflation figure such as energy, food and housing. Although headline inflation (measured by the CPI Index) is making progress back towards 2%, with a reading of 3.2% in February, supercore inflation has failed to fall meaningfully below 4% and has even gained momentum recently. The divergent trends in these two inflation measures are shown in the chart below.

Source: Bloomberg LLP, 2024

With evidence of economic strength mounting, expectations of interest rate cuts in the US and elsewhere have tempered. At the start of the year, the market expected the Fed to cut interest rates six times in 2024, starting in March. The Fed is now expected to implement just three rate cuts by the end of the year, with the first cut expected in July. These higher short-term borrowing costs are feeding into expectations for the longer term, with the benchmark 10-year US Treasury yield rising modestly over the quarter to finish at 4.2%. Importantly, long term inflation expectations remain relatively well anchored. This is a key factor in maintaining the Fed’s inflation-fighting credibility, as is refraining from cutting rates too early.

The dawning of this realisation on equity markets is creating some interesting opportunities. With a small handful of the largest companies in both the US and Europe having driven the lion’s share of the gains in equity indices in the last twelve months, in March we saw some signs of more diversified performance in equity markets. We believe this broadening of equity returns has further to run. The sectors that tend to outperform in an environment of resilient growth and higher interest rates include natural resources, financials and industrials. From a regional perspective, the UK, Japan and Europe have historically benefitted from these conditions, reflecting the greater representation of cyclical sectors in their markets.

Commodities stand out as one area of the market that is particularly ripe for a catch up with the evolution of the economic picture. The Bloomberg Commodity Index lost 12% last year, as recession fears in developed markets were compounded by a slew of poor economic data from China. Chinese imports account for over 70% of the global trade in iron ore, 72% of aluminium, and over 60% of both copper and soybeans, making the Chinese economy integral to the outlook for many commodities. With the US economic backdrop holding firm at the same time as data from China is beginning to surprise to the upside, most notably retail sales and industrial production, we expect the green shoots of recovery in certain supply-constrained commodities, for example copper, to continue.

Across the East China Sea, the Bank of Japan (BOJ) marked the end of the world’s last negative interest rate regime by raising its short-term policy rate for the first time in 17 years. As well as raising the rate from -0.1% to a range of 0%-0.1%, the Bank also abandoned a policy known as yield curve control, through which it artificially depressed the yields of certain government bonds in order to stimulate the economy. With annual wage negotiations between trade unions and companies producing the largest pay rises since 1991, the BOJ deemed these steps to be necessary to prevent inflation from building too much momentum.

With interest rates rising, albeit modestly, one might have expected the Japanese yen to strengthen as higher interest rates typically attract capital flows. However, after many years of depreciating value against its peers, the yen exhibited further weakness after the announcement. Once the dust settles, we believe the yen will regain some of its lost value against other currencies. For this reason, we currently prefer to hold our Japanese investments in yen, rather than hedging out the currency exposure. The catalyst for an appreciation in the Japanese currency is unclear, although a narrowing of the interest rate differential between Japan and the US could certainly get the ball rolling. Indeed, the economic picture in Japan looks supportive of further hikes in the short-term policy rate, whilst the direction of travel in US interest rates appears biased towards cuts, albeit with uncertainty remaining over the timing.

This changing monetary policy backdrop has nuanced implications for Japanese equities. With many listed companies generating significant revenue from exports, strength in the yen has historically caused some weakness in Japanese equities, as their overseas earnings diminish in value. Ultimately, we believe the economic forces that lie behind the recent changes in monetary policy will be supportive for Japanese companies in aggregate, despite the headwind that a stronger yen would represent for exporters. Indeed, the past quarter saw Japan’s best-known stock market index, the Nikkei 225, break through its all-time high of 38,957 points set 34 years ago. Anecdotally, investors we speak to in Japan underscore the psychological relief that breaking through this threshold represents. With an economic tailwind that has not existed for years, attractive valuations and accessible levers to return significant capital to shareholders, we are optimistic about the prospects for Japanese equities from here.

In many ways, it feels as though clarity has increased with the passing of three months. This is particularly true in Japan, but also feels apt as it relates to the path of the US economy. As ever, we remind ourselves that investing is the art of balancing probabilities and are therefore mindful that information must be separated from narrative. Nonetheless, current information leads us to be optimistic about the opportunities we see in the market from which our portfolios are positioned to benefit.