“Change is the law of life. And those who look only to the past or present are certain to miss the future.”

John F. Kennedy

A glance at the returns of all major asset classes over the past 12 months would confirm that 2022 has been incredibly challenging for investors. It has left those with a traditional approach to portfolio construction nursing particularly heavy losses in both equities and bonds. Whilst not immune, our portfolios have been able to weather the storm relatively well. Importantly, we believe that the events of the past year mark a structural change in the investment landscape which lends itself favourably to active management. Before explaining this point, we consider the key events of a year which, like 2008, will come to determine the defensive capabilities of investment managers.

From a geo-political perspective, it is hard to define the year by anything other than Russia’s invasion of Ukraine. The moral implications of the conflict and the severe disruption in the supply of critical resources have shaped international relations across the globe. The nature of discussions at November’s COP 27 global climate summit in Egypt would likely have been rather different if the orderly supply of energy to Europe had not been upended. Events in Ukraine have exacerbated the inflationary pressures in the global economy, with 2022 marking the return of extreme levels of inflation for the first time in over 40 years. At home, the UK has been coming to terms with the death of a monarch who reigned for 70 years, as well as coping with three different prime ministers and four chancellors of the exchequer. It has been a truly unprecedented year in many ways.

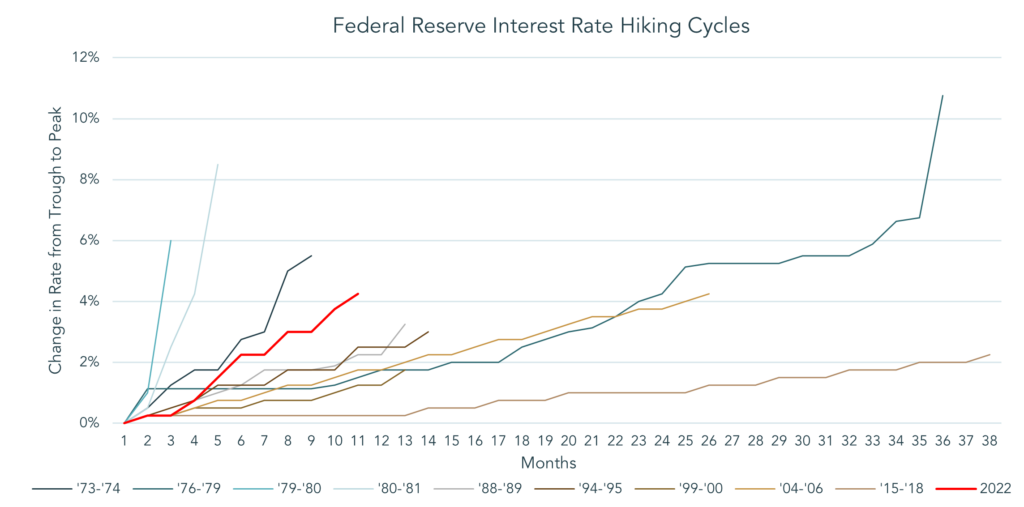

In response to inflationary pressure driven by rising energy and commodity prices, supply chain bottlenecks and robust consumer demand, major central banks have been forced to normalise monetary policy after more than a decade of excessive liquidity. As a result of central bankers’ initial reluctance to accept inflation as anything more than transitory, they have sought to bring their monetary policy up to speed through a series of relatively sharp interest rate hikes. Recent interest rate increases by the US Federal Reserve (the Fed) can be seen in a historical context below.

Source: Bloomberg LLP, 2022

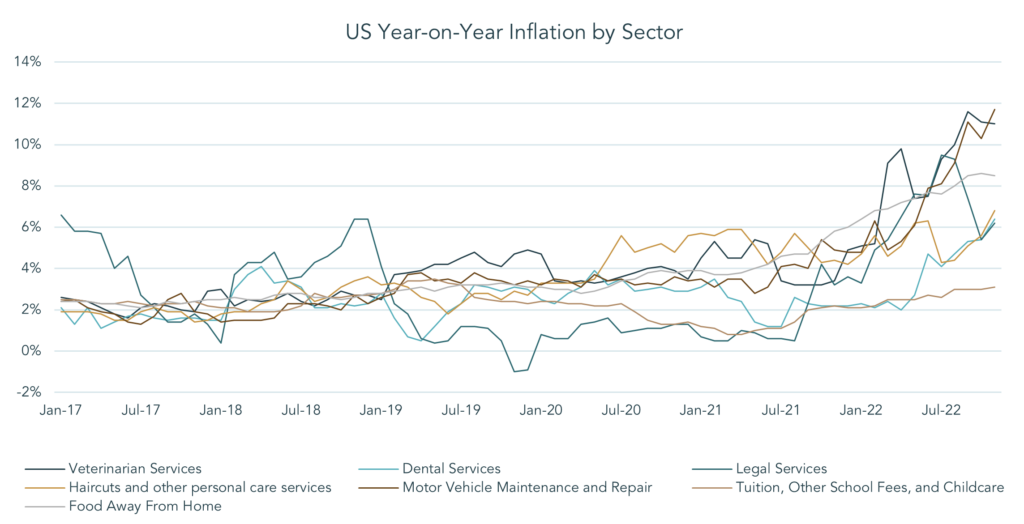

With global equity and bond markets having fallen 19.7% and 15.7% respectively in 2022, there has certainly been an adjustment to reflect the new monetary backdrop. That said, markets seem reluctant to acknowledge some of the implications of the new landscape. For instance, it is still assumed that inflation will glide back to the familiar 2% level by the end of 2024, as implied by the inflation assumptions priced into fixed income securities. Whilst inflation will ease as commodity prices fall and supply chain bottlenecks are alleviated, the type of inflation that concerns central banks most is that in service sectors which comprise the ‘Core’ Consumer Price Index measure. The negative feedback loop between consumer prices and wages can create a vicious circle in these sectors whereby rising prices prompt employees to demand higher wages which drives prices higher in industries where labour accounts for a high proportion of production costs and so on. Looking at price changes in the sectors shown below, the tightening of monetary policy to date does not yet seem to have had the desired effect of reducing inflation.

Source: United States Department of Labour, 2022

We are not proposing that the Fed and other central banks have lost control of inflation by any stretch. We would argue, though, that the market is too quick to anchor its expectations back to data of the past decade, an era of extraordinary monetary policy. Similarly, we believe that the market’s interest rate expectations are wrongly tied to recent history, with the Fed anticipated to start cutting rates as soon as summer 2023. With the labour market displaying resilience and inflation still running significantly above the Fed’s 2% target, it seems unlikely that US central bankers would reverse 18 months of rate hikes just as they seem to have caught up with the economy from a policy perspective.

By avoiding conventional fixed income securities, we were able to protect our portfolios from the severe losses in the bond market in the past 12 months. With the ‘higher for longer’ narrative yet to be fully reflected in interest rate and inflation expectations, we are comfortable retaining an unconventional approach within our fixed income allocation. However, having fallen significantly in value, government bonds are now starting to offer a more attractive yield and their value has scope to rise in the event that the forecast recession in 2023 is worse than expected. As a result, this asset class is now beginning to exhibit some of its traditional diversification benefits.

Whatever the Fed decides to do next year, we believe its role in driving the direction of the economy is likely to diminish in the coming years. Since 2007, the ratio of US economic output to monetary supply (cash in the system) has halved, meaning that the US economy requires a much greater cash base to produce a given level of output. Consequently, the boost to

GDP that the Fed can deliver with every dollar of money it creates has halved so, if the economy gets into difficulty, it will

be more of a challenge for the central bank to help. With the Fed and other major central banks having used most of the

ammunition in their monetary arsenal since 2008, the world economy will need to look beyond these institutions to guide its direction, as will equity and bond markets.

With liquidity in shorter supply, we expect markets to become stricter on the financial performance of companies, with lower profitability and stretched balance sheets likely to be penalised, and robust, cashflow-generative businesses likely to be rewarded. We have seen the beginnings of this environment in 2022, with unprofitable, high-growth companies suffering some of the heaviest losses in the equity market. With fundamental factors driving equity performance, the prospects for skilled fund managers to outperform the market are bright. Many of our managers have been doing just that in their respective regions or asset classes and we expect to see the gap between their returns and the returns of their benchmark indices widen.

Leaving behind a uniquely challenging year, we feel optimistic about the opportunity set for our portfolios. Many great companies see their shares trading on historically cheap valuations, presenting an opportunity for active managers to buy these companies at attractive prices. However, we cannot help but feel that financial markets as a whole are not yet out of the woods, with analyst consensus on corporate revenue growth and profitability still overly optimistic in our view. We are, therefore, pleased to be entering the year well-invested, but with a meaningful amount of cash waiting to be deployed. With markets still digesting the new economic environment, we feel confident that moments to deploy this capital in particularly compelling situations will present themselves in the coming months.