“We all need to get the balance right between action and reflection. With so many distractions, it is easy to forget to pause and take stock.”

Queen Elizabeth II

At the start of the summer, a traditionally quieter time for trading activity, investors around the world were likely hoping for a calmer period following the volatility experienced in the first half of the year. Unfortunately, financial markets did not oblige. In the quarter, the diversification benefits of conventional portfolio theory continued to be challenged, with equities, bonds and commodities all posting significant losses in response to central bank and inflation narratives. By maintaining an unconventional approach, our portfolios were protected from the worst of the volatility in these assets. We thought it would be helpful to chart below the moves of equities and bonds in response to some of the quarter’s key events, before going on to discuss them in more detail.

Source: Bloomberg LLP, 2022

The quarter was a tale of two halves, with equity markets performing strongly into August, before comments from Fed Chair Jerome Powell brought home the severity of the threat posed by inflation, prompting an aggressive slide in both bond and equity markets. Throughout the period, inflation numbers from the US and other major economies were hotly anticipated, with investors looking for clues to central banks’ next move in each data print. The data in aggregate provided support to the monetary tightening campaigns of most central banks, causing bond yields to push higher and bond values to fall. Against this unsettled backdrop, our fixed income allocation was resilient. By holding no traditional government bonds and retaining unconventional positions in corporate and high yield bonds, we were able to avoid the substantial capital losses in these asset classes. Meanwhile, equities resumed a familiar pattern in late August, with growth companies underperforming as investors discounted future profits at higher interest rates, giving them a lower value today.

Global currencies have also seen a large dispersion of returns this year. The US Dollar Index, a measure of the dollar’s value against six major currencies, hit a 20-year high in August, buoyed by rising US interest rates and relative strength in the US economy. For sterling investors holding assets in US dollars, the value of their foreign investments increased with the exchange rate move. This demonstrates the benefits of diversification, not only from an asset class perspective but also with an eye to currency. Contrastingly, exposure to the Japanese yen was disadvantageous, as the Bank of Japan’s reluctance to

raise interest rates drove the currency lower. The yen’s weakness was so severe that the government stepped in with ¥2.84tn ($19.7bn) of yen purchases in the final week of September, the first time Japan has intervened to buy its own currency since the late 1990s.

The dollar’s appreciation against sterling has been exacerbated recently following the appointment of Prime Minister Liz Truss. With Chancellor Kwasi Kwarteng’s ‘mini-budget’, the new leadership went beyond Truss’ campaign pledges, proposing more significant tax cuts across the board. In addition, the government introduced an energy price guarantee, capping domestic energy prices for two years, with the Treasury absorbing any increases above the cap. With energy priced in US dollars, the government has effectively committed to a US dollar liability of unspecified size, which is another reason for sterling’s recent weakness. The total cost of Kwarteng’s policies is estimated at c.£150bn (6% of UK GDP) and will be funded in the short term by issuing more government debt. The announcements landed poorly, with sterling selling off heavily and UK government bonds (gilts) falling sharply enough to cause a significant issue for pension funds. Whilst the worst of the losses have been recouped in the short term, with help from the Bank of England’s emergency interventions, the market reaction has exposed the sensitivity of the UK economy to rising interest rates and highlighted the immense challenge politicians will face in generating growth in this environment.

The UK was not alone in undergoing some profound political change this quarter. Italy, the Eurozone’s third largest economy, returned a parliamentary majority for Giorgia Meloni’s Brothers of Italy party in the September election. Investors will watch diplomatic relations at the core of the European Union with interest, as Meloni’s stance on key foreign issues is clarified. Looking forward, the calendar is punctuated with political landmarks on every continent. In the Americas, incumbent President Bolsonaro of Brazil will face former president Luiz Inácio Lula da Silva in a tight run-off vote in October. Shortly afterwards, Americans will go to the polls at the midterm elections, with the House of Representatives and around a third of the Senate in contention. The midterms will be important for President Biden, whose popularity has risen in the past 3 months, as they will dictate his ability to pass legislation for the remainder of his term, as well as gauging opinion ahead of the next presidential election. Before that, the 20th National Congress will be held by the Chinese Communist Party. President Xi Jinping’s leadership position will likely be re-affirmed at the event, although speeches and senior appointments could hold clues about policy direction in China going forward, a key area of focus recently in Asian markets.

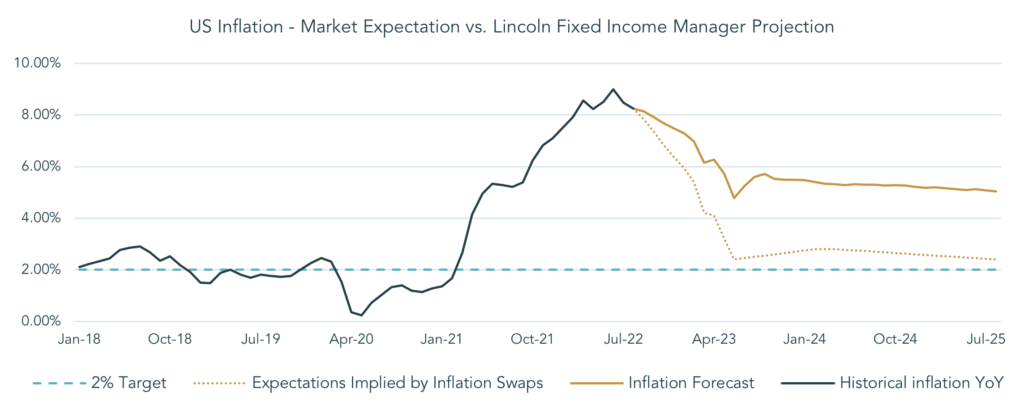

While politics will prove influential over the longer term, we expect the coming months will be dominated by central bank activity, inflation data, and the inevitable knock-on effect these factors will have on corporate earnings. The chart below shows the inflation assumptions currently priced into bond markets. We believe markets are exhibiting overconfidence in assuming that inflation will fall sharply back towards central banks’ target of 2% by mid-2023. It is more likely, in our view, that the Fed and other central banks will take longer to tame inflation, continuing to maintain monetary tightness in the face of economic hardship. That is not to say that interest rates and inflation will continue to rise at the rate we have seen. Indeed, we have likely passed the peak in inflation numbers. However, we believe the inflation projections of one of our fixed income managers, also charted below, are a better reflection of the likely reality in the next few years, with inflation rates unlikely to drop as quickly as expected by the market. We therefore remain comfortable with our unconventional positioning in fixed income as markets continue to digest economic data.

Source: Bloomberg LLP, 2022

One might deduce from this view that we are bracing ourselves for more quarters like the one we have just had. That is not quite true. Whilst we would say that the current prices of some assets look vulnerable to the downside, this year’s volatility has presented some remarkable opportunities for prospective returns. Parts of the equity market are now trading at valuations not seen since the financial crisis in 2008. Although these prices are reflective of economic risks, there are companies with robust balance sheets and bright long-term prospects that find themselves trading on extremely attractive valuations. By selecting such resilient companies, our active managers will enable our portfolios to weather a period of economic strain. Paying close attention to valuation when buying these equities should also allow our managers to produce outsized returns as market sentiment improves.

It would be remiss of us not to mention the war in Ukraine. At the time of writing, it does appear that Western support has enabled Ukraine to shift from defence to offence. This change of momentum is a setback for Putin and undoubtedly it raises risks surrounding the conflict. However, it is interesting to observe that virtually zero probability is currently ascribed by financial markets to a resolution in Ukraine. It is admittedly hard to imagine at this stage, but August’s deal over grain exports offers a glimmer of hope for some sort of diplomacy between the two sides.